Last Will and Testament Template

Creating a Last Will and Testament is a crucial step in estate planning, ensuring your assets are distributed according to your wishes after your passing. To download a free Last Will and Testament template, click the button below. This template is essential for outlining your final wishes and providing peace of mind for you and your loved ones.

Save time, avoid headaches, and ensure compliance effortlessly with current version of Last Will and Testament Template. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Understanding the Template

Secure Your Legacy: Download Your Last Will and Testament Template Today

Are you tired of the thought of leaving your estate planning to chance? It's a common concern, and without proper documentation, your assets may not be distributed as you wish. The process of creating a Last Will and Testament can seem daunting, filled with legal jargon and complex decisions. But what if there was a way to simplify this process? Imagine having a downloadable Last Will and Testament template at your fingertips, ready to customize instantly with just a click. Our Last Will and Testament Template, updated for the current year, provides a straightforward way to express your final wishes regarding your assets, guardianship for minor children, and any specific instructions you may have. This document is crucial for ensuring your estate is handled according to your desires, avoiding potential disputes among heirs or lengthy probate processes. After downloading the template, make sure to review and customize it carefully to reflect your specific wishes and comply with your state's laws.How to Fill Out a Last Will and Testament Template

Instructions for Completing Your Last Will and Testament

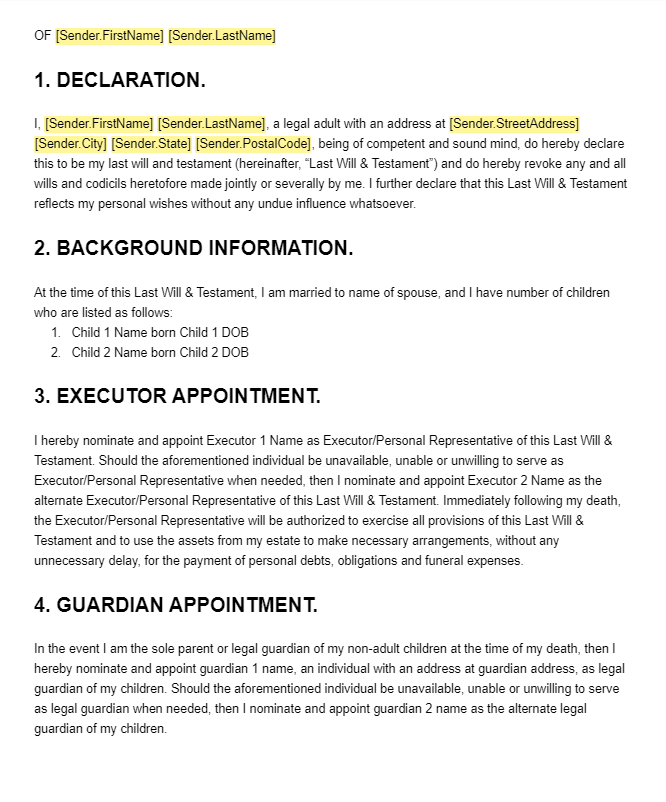

In the upper section, you are required to input your personal details, including your full name, address, and marital status. You may also need to specify your executor, who will be responsible for managing your estate according to the will. Subsequent sections will guide you through designating beneficiaries for your assets, appointing a guardian for minor children if applicable, and specifying any particular wishes you have for your funeral arrangements or the handling of your digital assets. The final section of the Last Will and Testament requires your signature, the date, and, depending on your jurisdiction, the signatures of witnesses or a notary public. Once the document is fully completed, it should be stored in a safe place and copies given to trusted individuals or your attorney. A new Last Will and Testament should be created if any significant life changes occur, such as marriage, divorce, the birth of a child, or a substantial change in assets. It's also wise to review your will periodically to ensure it still reflects your current wishes.Frequently Asked Questions

A Last Will and Testament is a legal document that outlines how your assets should be distributed after your death. It can also specify guardianship for minor children and any specific wishes you have for your estate.

The primary purpose of a Last Will and Testament is to ensure your assets are distributed according to your wishes, guardians are appointed for minor children, and any specific instructions you have are followed.

You can download a Last Will and Testament template for free from reputable sources like our website Blue Notary or consult with a legal professional to create a customized will.

Anyone with assets, minor children, or specific wishes for their estate after their passing should consider creating a Last Will and Testament.