Prenuptial Agreement Template

A Prenuptial Agreement, often referred to as a prenup, is a crucial legal document for couples planning to marry, outlining the division of assets, spousal support, and other important matters in the event of divorce or separation. To access our Prenuptial Agreement Template, click the button below. This template is essential for clarifying financial rights and responsibilities, protecting individual assets, and ensuring peace of mind for both parties entering into marriage.

Save time, avoid headaches, and ensure compliance effortlessly with current version of Prenuptial Agreement Template. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Understanding the Template

Prenuptial Agreement Template Instructions

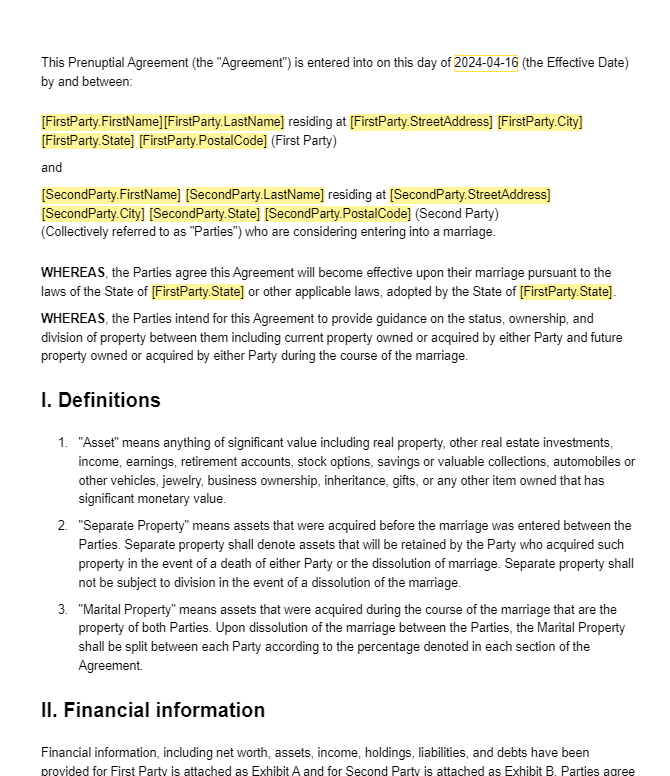

- Parties Involved: Clearly identify the parties involved in the agreement, i.e., the prospective spouses. Include their full names, addresses, and contact information.

- Assets and Debts: List all assets and debts owned by each party individually or jointly before the marriage. This may include real estate, bank accounts, investments, vehicles, personal belongings, and liabilities.

- Property Division: Specify how assets and debts will be divided in the event of divorce or separation. Outline whether certain assets will remain separate property or be considered marital property subject to division.

- Spousal Support: Address whether spousal support (alimony) will be paid in the event of divorce or separation. Specify the amount, duration, and conditions for spousal support, if applicable.

- Inheritance Rights: Clarify how inheritance rights will be handled in the event of one spouse's death. Specify whether the surviving spouse will waive their rights to inherit from the other spouse's estate.

- Governing Law and Jurisdiction: Specify the governing law and jurisdiction for any disputes arising from the agreement. This ensures that both parties understand the legal framework under which the agreement will be interpreted and enforced.

- Execution and Notarization: Both parties must sign the prenuptial agreement in the presence of witnesses and a notary public to make it legally binding. Ensure that all signatures are properly executed and witnessed according to local laws.

Frequently Asked Questions

A Prenuptial Agreement Template is a standardized document used to formalize the terms of a prenuptial agreement between two individuals planning to marry. It outlines their respective rights and obligations regarding finances, property, and other matters in the event of divorce or separation.

Couples planning to marry who wish to clarify financial rights and responsibilities, protect individual assets, or address other financial concerns should use a Prenuptial Agreement Template. It provides peace of mind and legal protection for both parties entering into marriage.

You can download the Prenuptial Agreement Template for free from reputable sources like our website BlueNotary or from legal and marriage resources.