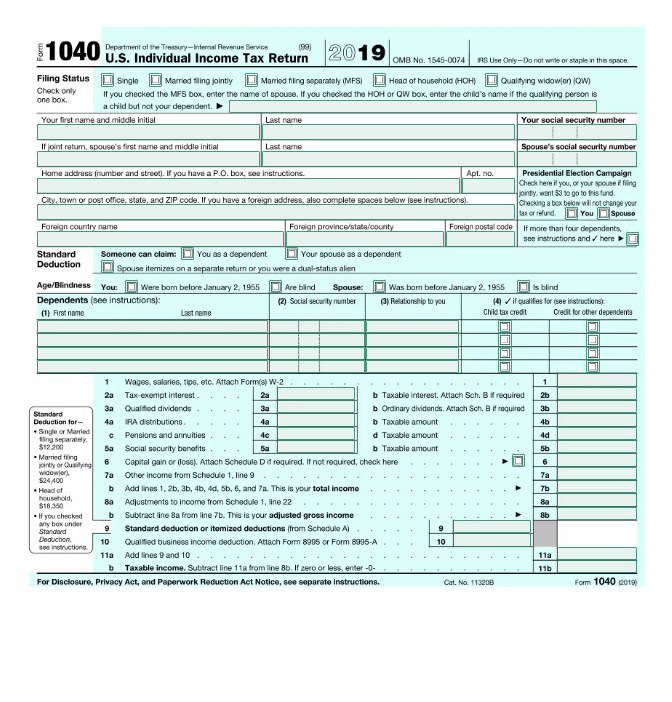

1040 Form Template

Save time, avoid headaches, and ensure compliance effortlessly with current version of 1040 Form Template. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Understanding the Template

Stay Compliant, Stay Secure: Secure Your 1040 Form Template Today

Are you tired of navigating complex tax forms and regulations? It's a daunting and time-consuming task, isn't it? Spending valuable time deciphering tax laws, gathering financial documents, or worse, risking errors that could lead to penalties. But what if there was a simpler way? Imagine having a downloadable 1040 Form Template at your fingertips, ready to fill out with just a click. The 1040 Form Template 2024 serves as the primary document for individual taxpayers to report their annual income, deductions, and credits to the IRS. Whether you're filing as a single filer, married couple, or head of household, utilizing this template ensures accurate reporting and compliance with tax laws. After downloading the template, make sure to follow the instructions carefully to input your tax information correctly.How to Use the Template

1040 Form Template Instructions

- Personal Info: Fill in your name, address, Social Security number, and filing status.

- Income: Report all income sources: wages, salaries, tips, interest, dividends, etc.

- Adjustments: Note deductions like IRA contributions, student loan interest, etc.

- Deductions: Choose between standard deduction or itemizing expenses like mortgage interest, medical expenses, etc.

- Taxable Income: Subtract deductions from total income to get taxable income.

- Tax Calculation: Use tax tables to calculate tax based on taxable income and filing status.

- Credits: Apply any eligible tax credits like EITC or Child Tax Credit.

- Payments: Enter federal income tax withheld, estimated tax payments, and refundable credits.

- Signature: Sign and date the form.

- Filing: Mail paper returns to the correct address or e-file electronically.

- Organize documents before filling out the form.

- Double-check entries for accuracy.

- Use tax software for easier calculations.

- Keep copies of your tax return and supporting documents.

- Consider seeking professional help if unsure about any part.

Frequently Asked Questions

You can download the 1040 Form Template for free from reputable sources like our website BlueNotary or directly from the IRS website.

The 1040 Form Template is designed for individual taxpayers in the U.S., including employees, self-employed individuals, and retirees, to file their annual tax returns accurately. Tax preparers also utilize this template to assist clients.

The 1040 Form Template is a standardized document used by individual taxpayers to report their annual income, deductions, and credits to the IRS. It serves as the primary tax form for most taxpayers in the United States.

If you need to update or correct information after beginning your 1040 Form, simply edit the fields directly on the template before submitting. Ensure all changes reflect accurate financial data to avoid issues with the IRS. For submitted forms, you must file an amended return using Form 1040-X.