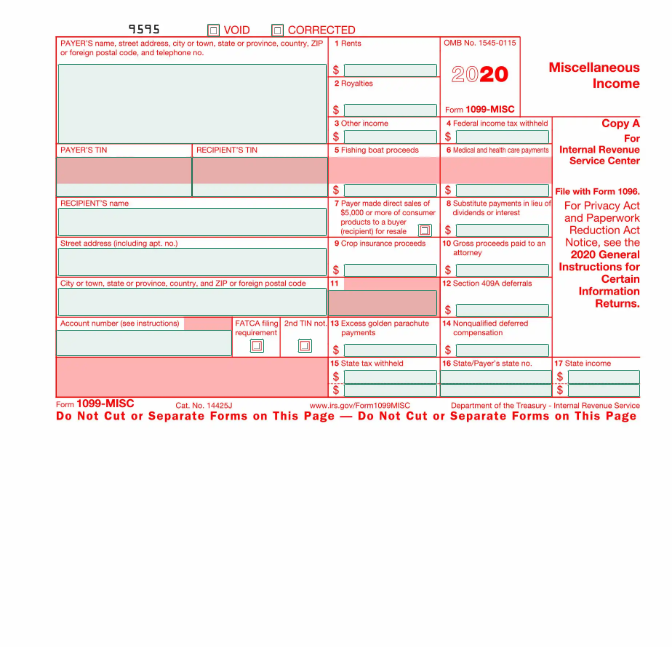

1099-MISC Form Template

Whether you're a business owner issuing payments to independent contractors or a self-employed individual reporting miscellaneous income, having a comprehensive 1099-MISC Form Template is essential for tax compliance. To access our 1099 MISC Form Template, click the button below. This template is vital for accurately reporting income and ensuring compliance with IRS regulations.

Save time, avoid headaches, and ensure compliance effortlessly with current version of 1099-MISC Form Template. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Understanding the Template

Stay Compliant, Stay Secure: Secure Your 1099-MISC Form Template Today

Are you tired of navigating through complex tax forms and regulations? It's a daunting and time-consuming task, isn't it? Spending valuable time deciphering tax laws, gathering financial information, or worse, risking errors that could lead to penalties. But what if there was a simpler way? Imagine having a downloadable 1099-MISC Form Template at your fingertips, ready to fill out with just a click. The 1099-MISC Form Template serves as a crucial document for reporting miscellaneous income paid to individuals or businesses. Whether it's payments to contractors, rental income, royalties, or other types of income, utilizing this template ensures accurate reporting and compliance with tax laws. After downloading the template, make sure to customize it according to your specific income and payment details.How to Use the Template

1099-MISC Form Template Instructions

In the designated sections of the template, payers are required to input specific details, including the recipient's information (such as name, address, and taxpayer identification number), payment amounts, and the type of income being reported. Payer Information: Provide your name, address, and taxpayer identification number (TIN), typically your employer identification number (EIN). Recipient Information: Include the recipient's name, address, and taxpayer identification number (TIN), typically their Social Security number (SSN) or employer identification number (EIN). Payment Details: Specify the total amount paid to the recipient during the tax year in Box 7, "Nonemployee Compensation." This includes all payments for services rendered, rents, prizes, awards, and other miscellaneous income. Other Information Boxes: If applicable, fill out other boxes on the form to report other types of payments, such as rents or royalties (Box 1), medical and health care payments (Box 6), and more. State Reporting: Depending on state requirements, you may need to fill out state-specific information boxes for state tax reporting purposes. Check the requirements for the states where the recipient performed services. Filing Information: Include the payer's name, address, and TIN in the "Payer's name" and "Payer's TIN" fields at the top of the form. Recipient Copy: Once completed, provide Copy B of the 1099-MISC form to the recipient. Send Copy A to the IRS along with Form 1096, which serves as a summary transmittal for all 1099 forms being filed. It's crucial to ensure that all information provided in the 1099-MISC form is accurate and matches the records maintained by the payer. Any discrepancies may lead to further inquiries from tax authorities.Frequently Asked Questions

A 1099-MISC Form Template is a standardized document used to report miscellaneous income paid to individuals or businesses during the tax year. It is typically used to report income such as nonemployee compensation, rents, royalties, and other types of income.

Businesses and individuals who make payments to independent contractors, freelancers, landlords, and others for services rendered should use a 1099-MISC Form Template to report miscellaneous income to the IRS and the recipients. Recipients of such income should also use this form when reporting it on their tax returns.

Failing to file a 1099-MISC Form correctly can result in substantial penalties from the IRS. These penalties vary depending on how late the form is filed and can increase over time. Additionally, intentional disregard for filing requirements may lead to even higher penalties. It is crucial to file accurately and timely to avoid these potential financial consequences.

You can download the 1099-MISC Form Template for free from reputable sources like our website BlueNotary or directly from the IRS website.