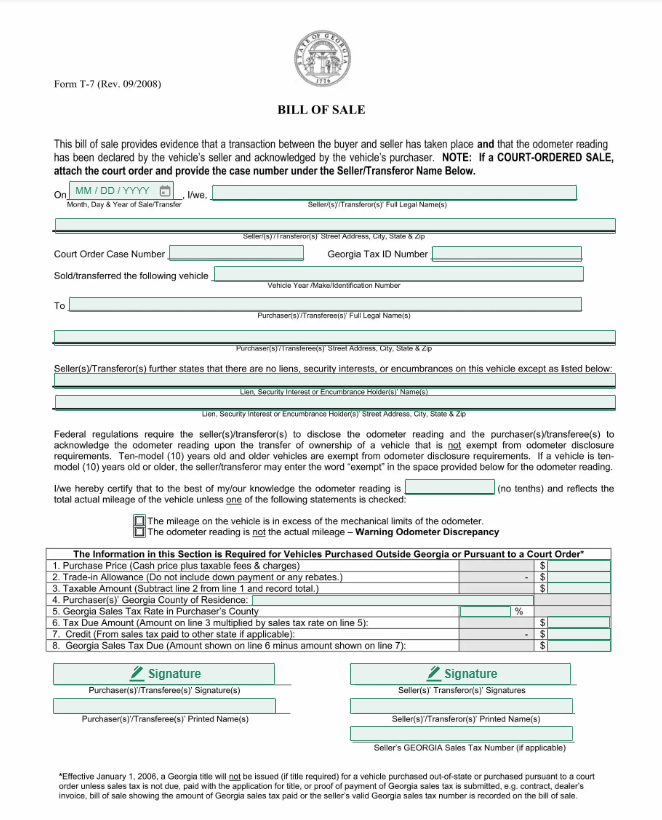

Georgia Bill of Sale Form

Save time, avoid headaches, and ensure compliance effortlessly with current version of Georgia Bill of Sale Form. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Understanding the Form

Ease Your Documentation Process: Access Your Georgia Bill of Sale Form Now

Dealing with paperwork and navigating bureaucratic processes can often be exhausting, can't it? It involves spending hours on complex websites or standing in lengthy queues, and there’s always a risk of facing penalties if not compliant.What if you could eliminate this inconvenience? Imagine the ease of accessing your Georgia Bill of Sale form online, ready to be downloaded instantly with just one click.For 2024, the updated Georgia Bill of Sale form is an indispensable legal document designed to document the transfer of various assets such as vehicles, boats, and personal items like furniture or electronics from one individual to another. It is vital for both the seller and buyer as it not only confirms the change of ownership but also includes detailed information about the condition and specifics of the item being sold.Especially important for private transactions in Georgia, the Bill of Sale is crucial for proper registration and tax documentation for larger items like vehicles or boats.How to Fill Out a Georgia Bill of Sale Form

Frequently Asked Questions

The W-9 form is an IRS document used to gather taxpayer identification numbers (TINs) from individuals or entities that may receive income. It provides necessary information for reporting income paid to you to the IRS.

The W-9 form is primarily used to obtain the TIN of a taxpayer for income reporting purposes. Entities that pay income to you, such as clients or employers, use this information to prepare and submit various tax documents, including 1099 forms.

You can download the W-9 form for free from reputable sources like our website or directly from the IRS website.

Individuals or entities that are receiving income, such as independent contractors, freelancers, landlords, and businesses, are typically required to fill out a W-9 form.