Owner Financing Contract Template

Whether you're a property owner looking to finance the sale of your property or a buyer seeking owner-financing options, having a well-structured Owner Financing Contract is essential for clarity and legal protection. To download the Owner Financing Contract Template for free, click the button below. This template is crucial for outlining loan terms, payment schedules, and other essential agreements between the parties involved.

Save time, avoid headaches, and ensure compliance effortlessly with current version of Owner Financing Contract Template. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Understanding the Contract

Stay Informed, Stay Protected: Secure Your Owner Financing Contract Today

Are you tired of navigating complex financing agreements without clarity? Drafting and negotiating financing terms can be daunting and time-consuming, leading to confusion and disputes down the line. Imagine having a ready-to-use Owner Financing Contract Template at your fingertips, providing clear terms and legal protection with just a click. Our Owner Financing Contract Template, tailored for 2024, is a comprehensive agreement designed to clarify the terms of property financing between owners and buyers. It covers important aspects such as loan terms, interest rates, payment schedules, and foreclosure procedures, ensuring both parties are protected and informed throughout the transaction.How to Fill Out an Owner Financing Contract Template

Owner Financing Contract Template Instructions

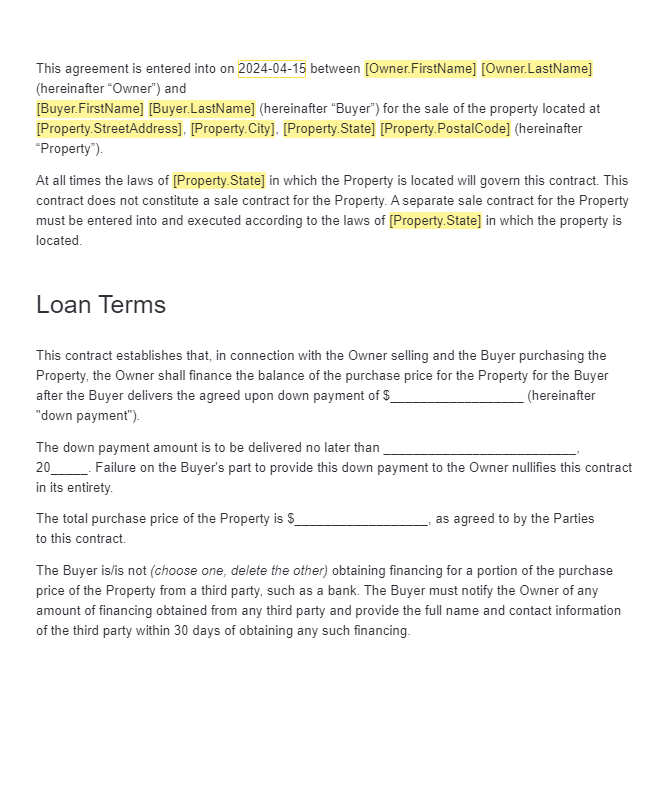

Prepared for: Buyer Information: Enter the full name of the buyer, including first and last name.Example: John DoeOwner Information: Provide the full name of the property owner who is offering financing.Example: Jane SmithContract Details: Property Information: Fill in the street address, city, state, and postal code of the property being sold.Example: 123 Main Street, Anytown, CA 12345Loan Terms: Specify the agreed down payment amount and the deadline for its delivery by the buyer.Indicate the total purchase price of the property.Clarify whether the buyer is obtaining financing from a third party and provide details if applicable.Define the amount of financing the owner will provide and the terms of the promissory note.Determine the interest rate and payment frequency for the mortgage.Address any prepayment options or penalties associated with the financing.Outline the foreclosure procedures in case of default by the buyer.Loan Servicing: Decide whether a loan servicing company will be hired to handle payment processing and document creation.Specify any fees associated with loan servicing and the responsibilities of the owner and buyer in handling them.Signatures: Have both the owner and buyer sign and date the contract to make it legally binding.Frequently Asked Questions

An Owner Financing Contract is a legal agreement between a property owner and a buyer, outlining the terms of financing provided by the owner for the purchase of the property.

It is used to establish the loan terms, payment schedule, and other conditions of owner financing, providing clarity and legal protection to both parties involved in the transaction.

Download a customizable template for free from reputable sources like our website or consult a legal professional to create one tailored to your specific transaction.

Both the property owner offering financing and the buyer seeking financing must fill out this contract to formalize the terms of their agreement.