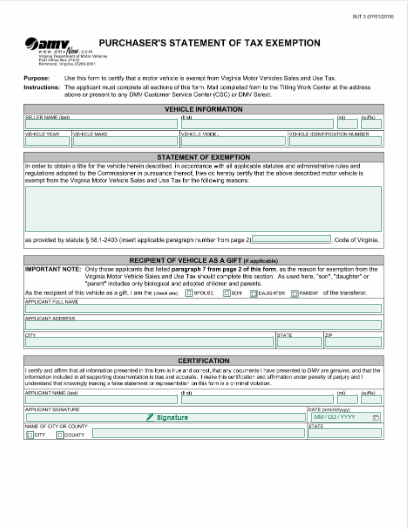

Purchaser’s Statement of Tax Exemption Template

A Purchaser's Statement of Tax Exemption is a crucial document used to claim exemption from taxes on specific purchases. It serves as proof of eligibility for tax exemption and includes important details about the transaction. To access our guide on creating a comprehensive Purchaser's Statement of Tax Exemption, click the button below. This template is essential for ensuring compliance with tax regulations and documenting exemption claims.

Save time, avoid headaches, and ensure compliance effortlessly with current version of Purchaser’s Statement of Tax Exemption Template. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Understanding the Template

How to Use the Template

- Purchaser Information: Clearly state the full name, address, and contact information of the purchaser claiming tax exemption.

- Purchase Description: Provide detailed information about the purchase, including type of goods or services, transaction details, and any relevant documentation supporting the exemption claim.

- Tax Exemption Eligibility: Specify the grounds for claiming tax exemption, such as educational, medical, or charitable purposes. Include any supporting documentation required by tax authorities.

- Signatures and Date: Provide space for the purchaser to sign and date the statement, indicating their agreement to the terms outlined in the document. Include a statement affirming that the Purchaser's Statement of Tax Exemption constitutes a valid claim for tax exemption.

Frequently Asked Questions

A Purchaser's Statement of Tax Exemption is a legal document used to claim exemption from taxes on specific purchases. It outlines the grounds for exemption and serves as proof of eligibility for tax exemption.

Anyone making a purchase and claiming tax exemption should use a Purchaser's Statement of Tax Exemption template. This includes individuals, organizations, and entities eligible for tax exemption under applicable laws.