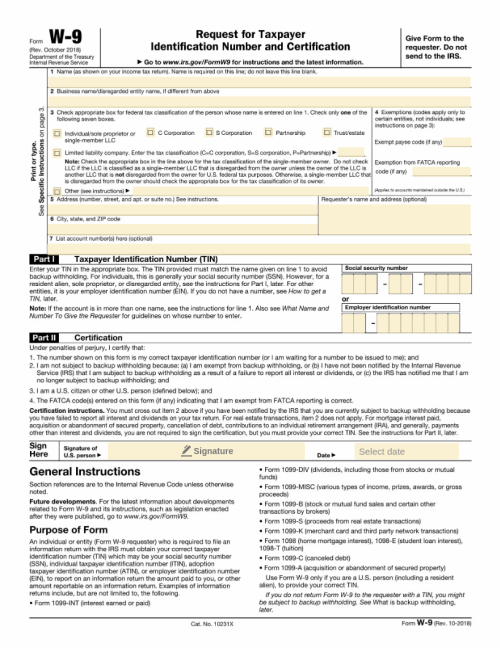

W-9 Tax Form

The W9 tax form also called the "Request for Taxpayer Identification Number and Certification" form, is a document in the US income tax system used by a third party who must file an information return with the IRS.

Save time, avoid headaches, and ensure compliance effortlessly with current version of W-9 Tax Form. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Who needs to complete a W-9 form?

Independent contractors

As an independent contractor, you’re required to pay taxes on the income you earn and you must file a tax return with the IRS each year.Your employer will not retain money for taxes, in the same way, they would for permanent employees, so you’re responsible for doing the accounting yourself.To do that, you’ll need a 1099 form from each company that you’ve completed contract work.To ensure that you receive your 1099s in time for tax season, you’ll need to submit a completed W-9 tax form to each company prior to working on projects for them.This guarantees that they have all of the information they need to file their taxes with the IRS, and to generate and send your 1099 for your personal income tax return.Form W-9 will need information such as the contractor’s full name, the business’ name, what kind of business it is, and the tax identification number/Social Security number (depending on whether the contractor is a business or a sole proprietor).You will also need to include information about your ‘backup withholding’ status.It’s unlikely you’ll be subject to backup withholding, however, if you are the contractee then you will need to withhold tax from your pay. This is typically a fixed rate of 24% for the 2018 to 2025 tax years.Employers

If you manage payroll or taxes for a company, it’s important that you keep a completed W-9 on file for each active working employee and contractor.You’ll use W-9 tax forms to set up payroll for employees and to create W-2s and 1099 forms for every employee and contractor during the federal tax season every year.Tips and Instructions for use

- Individual

- C Corporation

- S Corporation,

- Limited Liability Company (LLC)

- Corporation

- trust/estate, or other.

Frequently Asked Questions

The W-9 form is an IRS document used to gather taxpayer identification numbers (TINs) from individuals or entities that may receive income. It provides necessary information for reporting income paid to you to the IRS.

The W-9 form is primarily used to obtain the TIN of a taxpayer for income reporting purposes. Entities that pay income to you, such as clients or employers, use this information to prepare and submit various tax documents, including 1099 forms.

You can download the W-9 form for free from reputable sources like our website or directly from the IRS website.

Individuals or entities that are receiving income, such as independent contractors, freelancers, landlords, and businesses, are typically required to fill out a W-9 form.