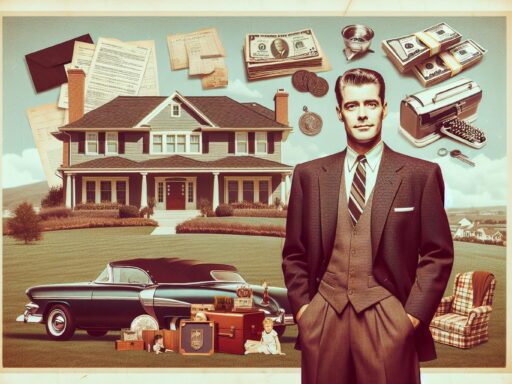

Understanding the concept of an estate is crucial for anyone interested in property, inheritance, or financial planning. An estate encompasses everything a person owns, including real estate, personal property, and financial assets. Whether you’re drafting a will, planning for retirement, or managing a loved one’s affairs, knowing what constitutes an estate can make the process smoother and more efficient.

The term “estate” often surfaces in discussions about wills and probate, but its implications extend far beyond. It includes tangible assets like homes and cars, as well as intangible ones like stocks and bonds. By clearly defining an estate, individuals can ensure their assets are managed and distributed according to their wishes, providing peace of mind for themselves and their families.

What Is An Estate?

An estate represents the total net worth of an individual, covering all owned possessions and interests. This includes real property like homes and land, personal property such as vehicles and jewelry, and financial assets, including bank accounts and investments.

Estate planning ensures effective management and distribution of these assets. It’s vital in contexts like drafting wills, retirement planning, and managing affairs after death. Understanding what constitutes an estate aids in organizing and safeguarding assets, ensuring they align with the individual’s intentions and legal requirements.

Both tangible and intangible assets form part of an estate. Tangible assets encompass physical items one can touch and see, like furniture and collectibles. Intangible assets involve non-physical interests, such as stocks, bonds, and intellectual property rights.

Knowing the components of an estate is crucial for various legal and financial processes. For instance, in probate, courts assess the estate’s value to validate wills and resolve claims. Likewise, determining an estate’s scope is essential in tax planning to navigate potential estate taxes and liabilities effectively.

Being aware of what an estate includes provides individuals with peace of mind. They can ensure their assets are managed wisely and distributed according to their preferences, minimizing potential disputes among heirs and beneficiaries.

Types Of Estates

Estates can broadly be categorized into two main types, depending on the nature of the ownership and duration. These types are freehold estates and leasehold estates.

Freehold Estates

Freehold estates imply permanent ownership rights. They grant the owner legal rights to the property without a time limit. These estates fall into three main categories:

- Fee Simple Estate: The most complete form of ownership, allowing the owner unrestricted rights to use, sell, or bequeath the property.

- Life Estate: Limited ownership tied to the lifespan of an individual. Upon their death, the property passes to another party.

- Fee Tail Estate: A historical form of ownership that limits inheritance to direct descendants. It’s no longer common in modern law.

Leasehold Estates

Leasehold estates involve temporary rights to use and occupy real property, which revert to the owner after the lease term ends. These estates are generally categorized by the terms of the lease agreement:

- Estate for Years: Fixed-term lease with a specific start and end date. Common for residential and commercial leases.

- Periodic Tenancy: Automatically renewing lease, such as month-to-month, which continues until either party terminates it.

- Estate at Will: Flexible agreement where either party can terminate the lease at any time without notice.

- Tenancy at Sufferance: Occurs when a tenant remains in the property after the lease term expires without the landlord’s consent.

Each type of estate addresses different needs and legal contexts, providing a structured way to manage property ownership and use.

Components Of An Estate

An estate comprises various elements that together form an individual’s total net worth. To understand it thoroughly, it’s essential to examine its primary components.

Real Property

Real property refers to land and anything permanently attached to it. This includes residential homes, commercial buildings, and vacant land. Ownership rights extend to structures and fixtures on the land, such as fences or garages. Real property is generally immovable, distinguishing it from personal property. Evaluation of real property is crucial in estate planning and probate processes because it represents significant portions of an estate’s value. According to the Federal Reserve’s Survey of Consumer Finances, real estate constitutes nearly 30% of American household wealth.

Personal Property

Personal property encompasses movable assets. Examples include vehicles, jewelry, furniture, and electronics. Unlike real property, personal property can be easily transferred or sold. For estate purposes, personal property involves both tangible (physical objects) and intangible items (stocks, bonds, and intellectual property rights). Assessing personal property is vital for accurate estate valuation and legal documentation. Tax regulations also treat personal property differently, making its identification and categorization important for compliance and asset distribution.

Legal Aspects Of Estates

Legal aspects of estates encompass critical issues in estate planning and the probate process. Understanding these ensures proper management and distribution of an individual’s assets.

Estate Planning

Estate planning involves arranging for the transfer of an individual’s assets after death. It includes drafting wills, setting up trusts, and appointing beneficiaries. A valid will dictates how assets are distributed, reducing the risk of disputes. Trusts provide added control over assets, potentially offering tax benefits. Appointing an executor in the will ensures someone is legally responsible for managing the estate. Legal documents, such as durable powers of attorney and healthcare directives, play a crucial role in estate planning, granting authority to others to make decisions if the individual is incapacitated.

Probate Process

The probate process validates a deceased’s will and ensures the correct distribution of assets. It begins when the executor files the will with the probate court. The court authenticates the will, allowing the executor to settle debts and distribute assets. If no will exists, the court follows state laws of intestacy to distribute assets. Probate also involves inventorying assets, notifying creditors, and resolving claims. This legal procedure is essential to confirm that the decedent’s wishes are honored, and beneficiaries receive their rightful inheritance. Proper understanding of probate helps in navigating potential legal complexities efficiently.

Common Misconceptions

Several misconceptions surround the concept of an estate, leading to misunderstandings during estate planning and probate processes. Clarifying these misconceptions helps individuals make informed decisions about their assets.

Estate Only Includes Real Estate

Many assume that an estate only comprises real estate (houses, land). However, an estate includes all assets, both tangible (cars, collectibles) and intangible (stocks, bonds). A comprehensive view ensures proper planning.

Estate Planning is Only for the Wealthy

People often think estate planning is only necessary for the wealthy. This isn’t true. Estate planning benefits everyone by organizing assets, minimizing disputes, and ensuring wishes are honored. It’s vital regardless of net worth.

Wills Avoid Probate

A common belief is that having a will avoids probate. In reality, wills must go through probate for validation. Although a will guides asset distribution, the probate court supervises this process to ensure legal compliance.

Only Old People Need Estate Plans

Some believe estate planning is only for elderly individuals. This misconception overlooks the importance of planning at any age. Unexpected events can occur at any time, making early estate planning crucial for asset security.

Discover the Power of BlueNotary:

Integrate your Business, Title Company, or Law Firm to Satisfy your Customers and Decrease Turnaround

Get a document Notarized/Sign-up

Join the Free Notary Training Facebook Group

Conclusion

Understanding the concept of an estate is essential for effective asset management and distribution. It ensures that all possessions, from real estate to personal property and financial assets, are organized and protected. Recognizing the various types of estates and their legal implications helps individuals make informed decisions about ownership and use.

Estate planning provides peace of mind by minimizing disputes and navigating legal and tax requirements. It’s not just for the wealthy; everyone benefits from having a clear plan in place. Misconceptions can lead to complications, so it’s crucial to be well-informed. Early and thorough estate planning secures assets and aligns them with personal intentions.

Frequently Asked Questions

What is an estate?

An estate includes all of a person’s possessions, such as real estate, personal property, and financial assets. It represents an individual’s total net worth and is crucial for legal and financial processes like wills and probate.

Why is estate planning important?

Estate planning helps manage and distribute assets effectively, minimizing disputes among heirs and beneficiaries. It ensures your assets are handled according to your wishes and meets legal requirements.

What are the types of estates?

Estates are categorized into freehold estates and leasehold estates. Freehold estates include permanent ownership rights, while leasehold estates involve temporary rights to use property, reverting to the owner after the lease term.

What is included in an estate?

An estate includes both tangible assets (like homes, cars, and collectibles) and intangible assets (like stocks, bonds, and intellectual property rights). It encompasses everything that makes up an individual’s total net worth.

What is real property?

Real property refers to land and anything permanently attached to it, such as residential homes and commercial buildings. It often represents a significant portion of an estate’s value.

Is estate planning only for the wealthy?

No, estate planning benefits everyone regardless of wealth. It ensures all individuals, not just the wealthy, have their assets managed and distributed according to their preferences and legal guidelines.

Does having a will avoid probate?

No, having a will does not avoid probate. Wills must go through the probate process for validation, where courts assess the estate’s value, validate the will, and resolve any claims.

What is personal property in an estate?

Personal property includes movable assets such as vehicles, jewelry, and intangible items like stocks and bonds. These assets play a crucial role in an estate’s overall value and planning.

When should one start estate planning?

Estate planning should start as early as possible, regardless of age. Unexpected events can occur at any time, making early planning essential to ensure asset security and proper distribution.