To get a document notarized online, you don’t have to leave your desk. Just upload your paperwork to a secure portal, breeze through a quick identity check, then hop on a live video call with a state-commissioned notary.

This method—known as Remote Online Notarization (RON)—has become a fully recognized alternative to the old face-to-face process. No more traffic, no more waiting rooms, and no more printing dozens of pages.

Why Online Notarization Is a Game Changer

Most people associate notarization with driving somewhere, filling out forms, then hoping the notary is available. RON tosses that model out the window. With a stable internet connection, you can finalize legal documents from home, the office—or even a café.

And it’s not just a comfort upgrade. Think about real estate agencies or law firms that move hundreds of documents each month. Cutting down commute times and paperwork handling translates into real savings. Individuals racing to meet a deadline for a power of attorney or loan closing will appreciate the 24/7 availability.

The Driving Force Behind the Digital Shift

RON isn’t a flash in the pan—it’s backed by solid growth projections and updated laws. The global online notary service market is on track to hit $2 billion by 2025, with roughly 15% annual growth through 2033. You can read more about this market expansion on Archive Market Research.

Key reasons behind this surge include:

- Around-the-Clock Access: No more juggling 9-to-5 schedules. Notaries are ready when you are.

- High-Level Security: BlueNotary and similar platforms combine ID scans, biometric checks, and tamper-evident seals to keep documents safe.

- Fast Turnaround: Many users wrap up the whole process in under 10 minutes and download their sealed document immediately.

The move to online services reflects a wider trend where secure digital solutions are becoming essential. As noted by industry experts, the shift to online notarization is part of a broader trend, highlighting the necessity of digital transformation across various sectors, including finance and legal services.

Online notarization isn’t just a stopgap—it’s a genuine upgrade. By blending proven technology with trusted legal standards, RON delivers a more efficient, user-friendly experience for individuals and businesses alike. For a deeper dive, check out our piece on the unstoppable rise of online notarization.

What You Need Before Starting the Process

Knowing how to notarize a document online is one thing, but showing up prepared is what makes the process genuinely seamless. A few minutes of prep work can turn what might feel like a complex legal task into a simple, ten-minute session.

Think of it like gathering your ingredients before you start cooking—it just makes sure everything goes smoothly from the jump. The good news? The list is short, and you probably have everything you need already.

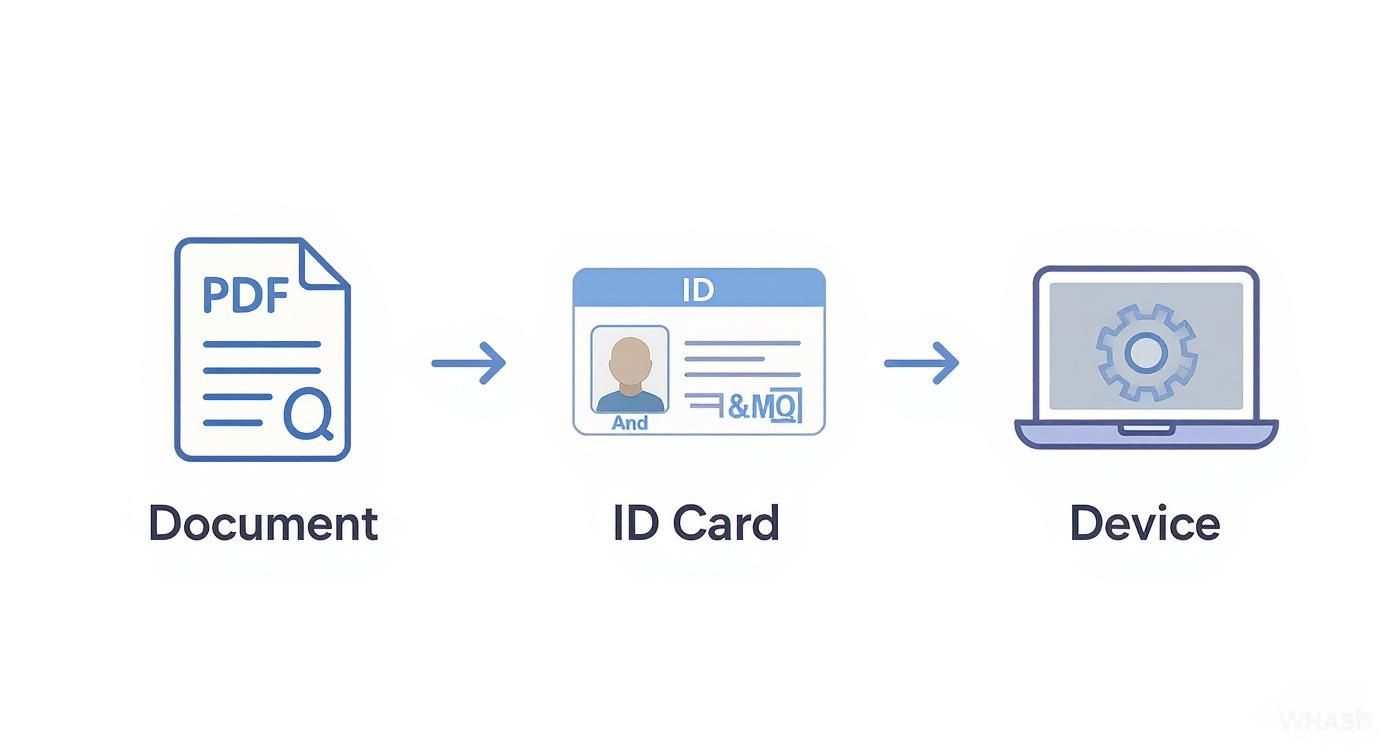

The Document Itself

First, you need the document. Since this whole process happens online, your document has to be in a digital format. A PDF file is the industry standard and is your best bet for compatibility with almost any platform, including BlueNotary.

Before uploading, give it a quick once-over to make sure all the necessary fields are filled out—names, dates, specific clauses, you name it. But there's one massive exception, and it's a big one:

Do not sign or date the document beforehand. The entire point of a notarization is for the notary to witness you signing in real-time during the live video session. If you sign it ahead of time, the notarization is invalid, and you'll have to start the whole process over.

This step is crucial no matter what kind of paperwork you're dealing with. The range of documents you can notarize online is huge, covering pretty much any personal or business need you can think of.

- Legal and Personal Documents: This includes things like affidavits, powers of attorney, consent letters for a minor to travel, and even a last will and testament.

- Financial Agreements: Think loan documents, promissory notes, or vehicle title transfers.

- Business and Real Estate Contracts: This covers everything from vendor agreements and corporate resolutions to deeds and mortgage closing documents.

Basically, if a document requires a traditional, in-person notarization, it's almost certainly eligible for Remote Online Notarization (RON).

Your Identification

The cornerstone of any notarization, online or off, is proving you are who you say you are. This is a non-negotiable step that protects everyone involved from potential fraud. For an online session, you’ll need a valid, unexpired, government-issued photo ID.

And you need the physical ID with you during the video call. Holding up a picture of it on your phone or a photocopy won't cut it. The notary needs to see the actual, physical ID on camera to compare it against the digital scans you provide during the identity-proofing stage.

The most common forms of ID that work perfectly are:

- A state-issued driver's license

- A U.S. Passport or Passport Card

- A state-issued identification card

- A military ID

It's also really important that the name on your ID matches the name on the document you're signing. Small variations can sometimes be worked out, but a major difference could definitely cause a delay. To be absolutely sure you've got the right ID, check out the complete list of acceptable IDs for notarization.

Your Technical Setup

Finally, you just need the right tech to connect with the notary. Don't worry, the requirements are super basic, and you don't need any fancy equipment. The key is just making sure your setup is stable.

Essential Tech Checklist:

- A Device with a Camera and Microphone: This could be a laptop with a built-in webcam, a desktop with an external one, a tablet, or even your smartphone. Your camera and mic absolutely have to be working, as the live video session is a legal requirement.

- A Stable Internet Connection: A choppy connection that keeps dropping can bring the session to a grinding halt. The entire audio-video interaction is recorded for legal compliance, so a solid connection is a must for a valid notarization.

- A Supported Web Browser: Most platforms, BlueNotary included, run best on modern browsers like Google Chrome, Firefox, or Safari. It's always a smart move to make sure your browser is updated to the latest version to dodge any weird compatibility issues.

With these three things ready to go—your digital document, your physical ID, and your tech—you're all set to get your document notarized online quickly and securely.

A Walkthrough of the Online Notarization Session

Okay, you've got your document prepped and your ID is sitting on your desk. Now for the main event. The actual online notarization session is surprisingly straightforward and, frankly, a lot less hassle than finding a local notary. The whole process is designed to be secure and efficient.

Let's break down exactly what happens, from the moment you hit "upload" to getting that final, legally-binding document in your hands. Knowing the flow ahead of time takes all the guesswork out of it.

Getting Started: Uploading Your Document Securely

First things first, you need to get your document onto the platform. Services like BlueNotary use secure, encrypted portals, so you don't have to worry about your sensitive information. You'll see a pretty clear prompt to either drag and drop your file or select it from your computer. It's as simple as attaching a file to an email.

This infographic lays out the essentials you need before you even get to this point.

As you can see, it really boils down to three things: your digital document, a valid government ID, and a device with a camera.

Once your document is uploaded, you’ll likely be asked to place little digital "flags" or tags where signatures and dates need to go. This is a super helpful step that ensures you and the notary don't miss a single spot during the live session.

Confirming It’s Really You: Identity Verification

This is probably the most critical part of the whole process. To keep everything legal and prevent fraud, the system needs to be absolutely sure you are who you say you are. This happens through a quick, automated process before you ever connect with the live notary.

It's a two-part check:

- Credential Analysis: You’ll be prompted to snap a picture of the front and back of your government-issued photo ID. The software then scans the ID's security features—holograms, microprint, the works—to make sure it's authentic.

- Knowledge-Based Authentication (KBA): Next, you'll get a few multiple-choice questions based on your public and personal records. Think old addresses or cars you've owned. These are things only you would know off the top of your head. You usually get about two minutes to answer around five questions.

This two-step verification is actually more robust than what you’d experience with many traditional, in-person notarizations. For a detailed look at this specific part, BlueNotary has a great guide on uploading your ID and biometrics with BlueNotary.

A Quick Tip: Do the ID check in a well-lit room. Glare from a window or bad lighting can make it tough for the software to read your ID, which could slow things down.

Once you pass these checks, you'll be put into a virtual waiting room to connect with a live notary.

The Face-to-Face Part: The Live Video Session

This is where you meet the commissioned notary public over a secure video call. They'll introduce themselves and confirm which state they're commissioned in. The entire session is recorded and stored, which is a legal requirement for Remote Online Notarization (RON).

During the short call, the notary will:

- Confirm Your Identity (Again): They’ll ask you to hold your physical ID up to your webcam. This is so they can visually match it to you and the images you uploaded.

- Check for Awareness: The notary will ask a couple of quick questions to make sure you understand the document you're signing and are doing it willingly.

- Witness Your Signature: You'll be prompted to electronically sign the document by clicking in the designated spots. The notary watches this happen in real-time.

After you've signed, the notary does their part. They'll affix their digital notary seal and electronic signature. This seal isn't just a picture; it contains encrypted data about their commission, making the document tamper-evident.

All Done: Receiving Your Notarized Document

The best part? The second the notary ends the video call, your document is done. No waiting for mail, no follow-up emails. You can immediately download the fully notarized PDF right from the platform.

The final file is now legally valid and includes the notary's digital certificate. This creates that tamper-evident seal we mentioned. If anyone tries to alter the document, the seal will be invalidated, which adds a powerful layer of long-term security.

This convenience and security is why the e-notary market is growing so fast. Valued at USD 261.99 million in 2025, it's expected to rocket past USD 797.53 million by 2037.

One of the first questions people ask when they hear about online notarization is straightforward: "Is this actually legal?"

The short answer is a firm yes. But knowing why it's legal gives you the confidence to move forward. The validity of an online notarization doesn’t depend on where you are—it's all about the laws in the state where the notary is commissioned.

This is the most important part to understand. If you're sitting in your home in California and connect with a notary who is commissioned in Virginia (a state with long-established RON laws), the notarization is legally performed under Virginia law. That's what makes the act valid and enforceable everywhere else.

The Power of Interstate Recognition

So, how can a document notarized under Virginia's laws be accepted in California, New York, or any other state? The legal foundation for this is incredibly strong. It’s built on principles like the Full Faith and Credit Clause of the U.S. Constitution and specific state-level laws about interstate recognition.

In simple terms, these laws require a legally performed notarial act in one state to be recognized as valid in all other states. This ensures your digitally notarized document carries the exact same legal weight as one stamped in person, no matter where you or the other parties are.

The key takeaway is that the physical location of the signer is irrelevant. As long as the remote online notary is state-commissioned and follows their state's established RON procedures, the notarization is legally binding across the entire United States.

This legal acceptance has fueled massive growth. Remote Online Notarization (RON) is no longer a niche service; it's a mainstream practice. As of 2025, more than 45 states have enacted permanent RON laws. This widespread adoption is a big reason why the RON market is projected to hit $1.8 billion by 2033, showing just how deeply it's being integrated into core industries. You can discover more insights about the top remote online notarization platforms on Proof.com.

Where Online Notarization Is Standard Practice

The acceptance of RON isn't just a legal theory—it's happening every single day across major sectors that depend on verified signatures. These industries didn't just dip their toes in the water; they jumped in headfirst for the efficiency, security, and undeniable convenience.

- Real Estate: Mortgage lenders and title companies now use RON to conduct entire property closings remotely. Think about it: a buyer in New York can finalize a deal on a Florida vacation home without ever leaving their living room, saving thousands in travel and days of lost time.

- Finance: Banks and financial institutions rely heavily on RON for loan agreements, wire transfer authorizations, and other high-stakes financial documents. It allows them to serve clients across the country securely and in minutes, not days.

- Legal Services: Law firms use online notarization for affidavits, powers of attorney, and even last wills and testaments. This has been a game-changer for serving clients who are elderly, have mobility challenges, or are traveling internationally.

For example, everyday documents like a rental agreement often need to be notarized to be fully enforceable. Online services make this a quick and simple task. You can even find resources like free rental agreement templates online to get the ball rolling.

State-Specific Considerations To Keep In Mind

While RON is accepted nationwide because of interstate recognition, a few states still have some unique rules or are in the process of finalizing their permanent legislation.

The good news? It's the platform's and the notary's job to worry about compliance, not yours. Platforms like BlueNotary are built on a foundation of trust and legality, exclusively using notaries who are fully commissioned and trained in states with clear, established RON laws.

This means you can move forward with total confidence. You know the legal framework is solid, and your final notarized document will be secure, tamper-evident, and recognized wherever you need to use it. The whole system is designed to work seamlessly, no matter which side of a state line you're on.

Choosing The Right Online Notary Platform

Remote Online Notarization (RON) gives you plenty of choices. Yet the platform you pick becomes the gatekeeper for your sensitive data and legally binding signatures. It’s not about bells and whistles—it’s about trust.

Think of it like choosing a bank partner. You want strong safeguards, transparent fees, and support when you need it. Your online notary should tick the same boxes, ensuring every click and keystroke stays secure and clear.

Security And Compliance First

A notary service must do more than link you to a notary—it needs to lock down every step. Here’s what I look for in a rock-solid platform:

- Identity Verification: Multi-factor checks and Knowledge-Based Authentication that dive deeper than a simple ID scan.

- Encrypted Connections: End-to-end encryption for video sessions and document transfers.

- Secure Document Storage: Audio-video recordings and signed files stored in a protected, audit-ready vault.

- Tamper-Evident Seals: Digital certificates that flag any post-notarization edits.

Key Takeaway: BlueNotary aligns with SOC 2 Type II, MISMO, and HIPAA controls—just like the protocols used by major banks.

That level of diligence means your documents stay verifiable and legally sound, today and years down the road.

The User Experience Matters

Security is crucial, but it shouldn’t feel like rocket science. A platform that guides you step by step turns a 30-minute chore into a five-minute task.

In my experience, the best services offer:

- A straightforward drag-and-drop document upload

- Clear, on-screen prompts for identity checks

- A smooth handoff into a live video session

- Instant access to download your notarized file

I once watched a first-time user breeze through their mortgage addendum in under ten minutes—no headaches, no support tickets.

Transparent Pricing And Availability

Nothing erodes trust faster than hidden fees. An honest provider spells out costs before you click “Start.”

- Flat-rate fees for individual notarizations

- Scalable subscription plans for businesses

- 24/7 on-demand access to state-commissioned notaries

With BlueNotary, you know exactly what you’ll pay—and you can launch a notarization at midnight if that suits your schedule. No more juggling 9-to-5 hours or surprise surcharges.

By balancing strong security, an intuitive interface, and clear pricing, you’ll end up with a platform that feels as reliable as your favorite hometown bank—only faster.

Got Questions About Online Notarization? We've Got Answers

Stepping into online notarization for the first time can feel like a big leap from the old paper-and-stamp routine. It's totally normal to have a few questions before you dive in. After all, you want to make sure you’re doing everything correctly, especially when important documents are involved.

Think of this section as your final check-in. We'll clear up the most common questions we hear, from the legal stuff to the "what if my Wi-Fi dies?" scenarios. Let’s get you feeling confident and ready to go.

Is Online Notarization Legally Binding in All 50 States?

Yes, it absolutely is. When a document is notarized online by a properly commissioned notary in a state that allows Remote Online Notarization (RON), it is legally recognized across the entire country.

This nationwide acceptance is backed by the U.S. Constitution’s Full Faith and Credit Clause, along with specific interstate recognition laws passed by various states. The key takeaway is that the notary's location and commission are what matter, not where the signer is. So, even if you’re in a state without its own RON laws, you can legally use an online notary from a state like Florida or Virginia, and your document will be valid everywhere.

What Kind of ID Do I Need?

For any online notarization, you'll need a current, unexpired, government-issued photo ID. This isn't just a suggestion—it's a strict requirement that protects everyone involved from fraud and ensures the integrity of the whole process.

The most commonly used IDs include:

- A state-issued driver's license

- A United States passport or passport card

- A state-issued non-driver ID card

- A valid military ID

The platform's technology will first analyze your ID's security features to make sure it's authentic. Then, during the live video session, the notary will ask you to hold up the physical ID to your camera for a final visual confirmation.

Pro Tip: Double-check that the name on your ID is an exact match for the name on your document. Small typos can sometimes be fixed, but a significant mismatch is a common reason for a notarization to be stopped in its tracks.

What Happens If My Internet Connection Drops?

We’ve all been there. Tech glitches happen, and good online notarization platforms are built to handle them. If you lose your internet connection during the live video session, you can usually just rejoin once you're back online. Your progress up to that point is typically saved.

However, the complete audio-video recording of the session is a non-negotiable legal requirement for RON. If the connection is unstable enough to interrupt the recording of the actual signing, you might have to restart the live session. It's a protocol designed to protect the legal standing of your notarized document.

Can I Notarize a Document for Someone in Another Country?

Yes, and this is one of the most incredible benefits of RON. It's a perfect solution for U.S. citizens who are traveling, working, or living abroad.

As long as the document is related to U.S. matters and the signer has a valid, government-issued U.S. ID, they can connect with a U.S.-based online notary from anywhere on the globe. The notarization happens under the laws of the notary’s commissioning state, making it fully valid back in the U.S. This erases huge logistical headaches and saves a ton of time and money, whether for international business deals or just signing a power of attorney while on vacation.

Ready to see how simple and secure it is to notarize your documents online? With BlueNotary, you can connect with a certified notary 24/7 and get your document legally notarized in just a few minutes. Get started with BlueNotary now.