Small Estate Affidavit California Form

When dealing with the estate of a deceased person in California, a Small Estate Affidavit can be a useful tool for transferring assets to heirs without the need for a lengthy probate process. To access our Small Estate Affidavit California Form, click the button below. This template is essential for simplifying the transfer of assets and navigating the legal requirements involved in handling small estates.

Save time, avoid headaches, and ensure compliance effortlessly with current version of Small Estate Affidavit California Form. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Understanding the Form

How to Use the Form

Small Estate Affidavit California Form Instructions

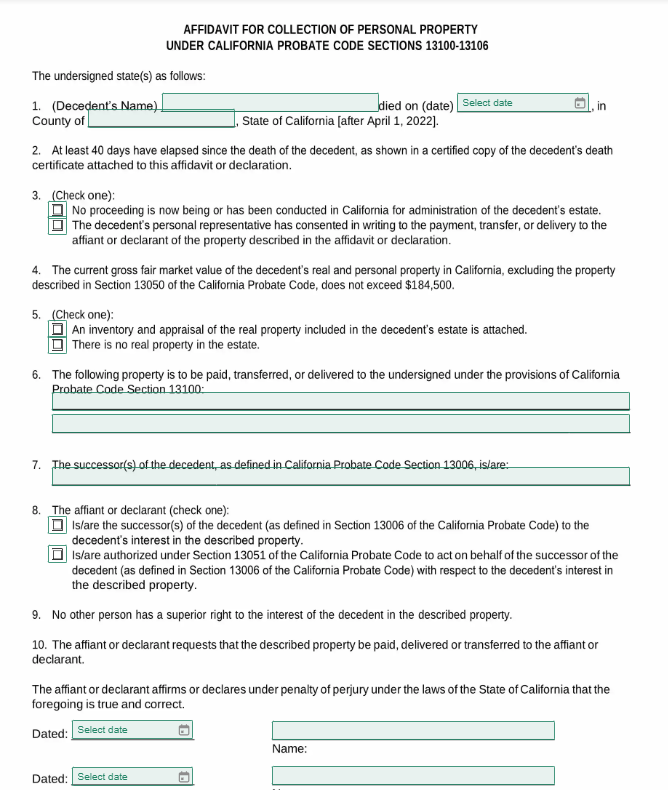

In the designated sections of the form, you'll provide information about the deceased person, the value and nature of the assets, and details about the heirs or beneficiaries entitled to receive them. Affiant Information: Provide personal details of the affiant (person filling out the affidavit), including their full legal name, address, and relationship to the deceased. Deceased Information: Include information about the deceased individual, such as their full legal name, date of death, and county of residence in California. Asset Information: List the assets of the deceased that are subject to the Small Estate Affidavit, including a description of each asset and its estimated value. Common assets may include bank accounts, vehicles, real estate (if it meets certain criteria), and personal belongings. Debts and Liabilities: Disclose any known debts or liabilities owed by the deceased at the time of death, along with their respective amounts. This may include outstanding bills, loans, or other financial obligations. Heir Information: Identify all heirs of the deceased, including their full legal names, addresses, and relationship to the deceased. This may include surviving spouses, children, parents, or other relatives entitled to inherit under California law. Declaration and Signature: The affiant must sign the Small Estate Affidavit under penalty of perjury, declaring that the information provided is true and correct to the best of their knowledge. Notary Acknowledgment: The affidavit must be acknowledged by a notary public, who will verify the identity of the affiant and witness their signature. It's crucial to ensure that all information provided on the form is accurate and truthful, as any inaccuracies or discrepancies could lead to delays or complications in the asset transfer process.Frequently Asked Questions

A Small Estate Affidavit California Form is a legal document used to transfer assets from the estate of a deceased person to heirs or beneficiaries without the need for probate. It provides a simplified process for settling small estates and distributing assets in accordance with California law.

Individuals who are entitled to inherit assets from a small estate in California, typically valued below a certain threshold, should use a Small Estate Affidavit California Form to expedite the transfer of assets and avoid probate. This form is particularly useful when the estate consists of assets that can be transferred without the need for court intervention.

You can download the Small Estate Affidavit California Form for free from reputable sources like our website BlueNotary or from legal and estate planning resources.

In California, a Small Estate Affidavit can be used if the total estate value does not exceed $166,250, allowing for a simplified transfer process without formal probate.