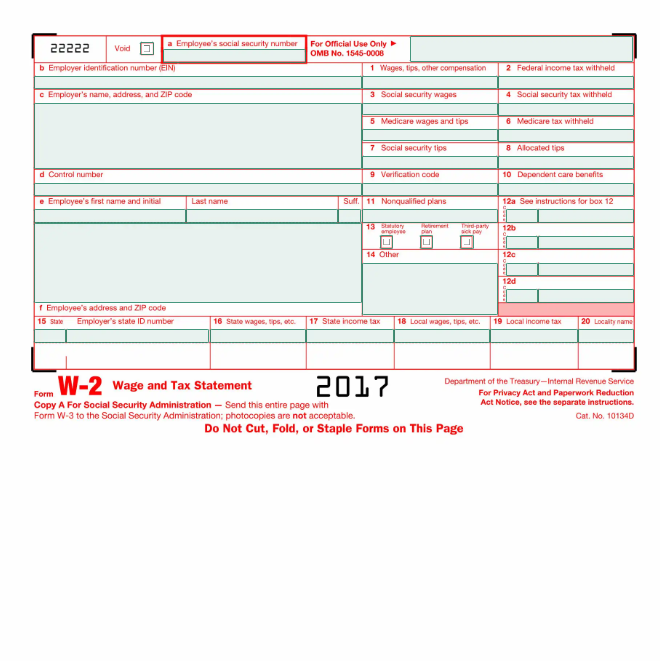

W-2 Form Template

Whether you're an employer preparing tax documents for your employees or an individual taxpayer needing to report income, having a comprehensive W-2 Form Template is essential for accurate tax filing. To access our W-2 Form Template, click the button below. This template is vital for documenting income and tax withholding information accurately and ensuring compliance with IRS regulations.

Save time, avoid headaches, and ensure compliance effortlessly with current version of W-2 Form Template. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Understanding the Template

Stay Compliant, Stay Secure: Secure Your W-2 Form Template Today

Are you tired of navigating through complex tax forms and regulations? It's a daunting and time-consuming task, isn't it? Spending valuable time deciphering tax laws, gathering employee information, or worse, risking errors that could lead to penalties. But what if there was a simpler way? Imagine having a downloadable W-2 Form Template at your disposal, ready to fill out with just a click. The W-2 Form Template 2024 serves as the primary tax document for reporting wages, tips, and other compensation paid to employees, along with tax withholding information. Whether you're an employer issuing W-2 forms to your employees or an individual taxpayer receiving one, utilizing this template ensures accurate reporting and compliance with tax laws. After downloading the template, make sure to customize it according to your specific circumstances.How to Use the Template

W-2 Form Template Instructions

Legal Requirement: Employers are legally obligated to provide each employee with a Form W-2, which summarizes their annual earnings and tax withholdings for the previous tax year. Failure to provide accurate W-2 forms can result in penalties from the IRS. Tax Reporting: Form W-2 is used by employees to report their income and taxes withheld when filing their individual income tax returns. It serves as an important document for both employees and the IRS in ensuring accurate tax reporting. Gather Required Information: Collect the necessary information for each employee, including their name, address, Social Security number, total wages, federal income tax withheld, Social Security wages and taxes withheld, Medicare wages and taxes withheld, and any other applicable information. Design the Template: Use a spreadsheet program or word processing software to design the template. Include labeled fields for each piece of information required on the Form W-2. Ensure Accuracy: Double-check the template to ensure that all fields are accurately labeled and aligned correctly. Pay special attention to numerical fields to avoid errors in calculations. Include Employer Information: Don't forget to include the employer's name, address, and Employer Identification Number (EIN) at the top of the form, as well as the employee's information in the designated fields. Formatting: Follow the formatting guidelines provided by the IRS for Form W-2. Use the official font size and style specified by the IRS, and ensure that the template fits on a standard 8.5" x 11" sheet of paper. Provide Instructions: Include instructions for both employees and employers on how to complete and distribute the Form W-2. This may include deadlines for distribution and filing, as well as any additional information required by the IRS. Testing: Before distributing the Form W-2 to employees, test the template by entering sample data to ensure that it calculates totals correctly and generates accurate results. Distribution: Once the template has been tested and verified, use it to generate Form W-2 for each employee. Provide each employee with their copy of the form and submit copies to the Social Security Administration and relevant state tax agencies as required by law.Frequently Asked Questions

A W-2 Form Template is a standardized document used by employers to report wages, tips, and other compensation paid to employees, along with tax withholding information. It serves as the primary tax form for employees to report their income to the IRS.

Employers who are required to issue W-2 forms to their employees should use a W-2 Form Template to accurately report income and tax withholding information. Employees who receive W-2 forms should also use this template to report their income when filing their tax returns.

You can download the W-2 Form Template for free from reputable sources like our website BlueNotary or directly from the IRS website.

Yes, the W-2 Form Template is regularly updated to reflect the latest IRS tax regulations and requirements. This ensures that employers and employees can rely on the template for accurate and compliant tax reporting each year. Always check for the most current version before preparing your tax documents.