Utah Bill of Sale Form

Whether you're a private seller, buyer, or a business entity, understanding and correctly filling out the Utah Bill of Sale form is essential for legal compliance. To download the Utah Bill of Sale form for free, click the provided link. This document is vital for accurately recording the sale and transfer of ownership of property, and it assists in adhering to state regulations.

Save time, avoid headaches, and ensure compliance effortlessly with current version of Utah Bill of Sale Form. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Understanding the Form

Stay Compliant, Stay Secure: Secure Your Utah Bill of Sale Form Today

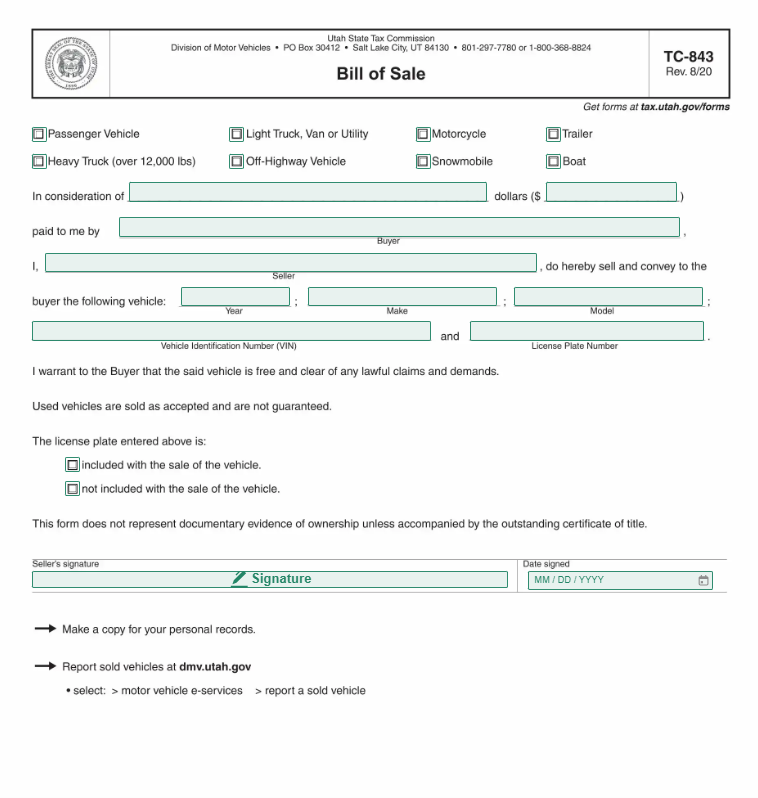

Are you tired of endless paperwork and bureaucracy when it comes to forms like this?It's frustrating and time-consuming, isn't it? Spending precious hours navigating through confusing websites, waiting in long queues, or worse, risking penalties for non-compliance.But what if there was a way to bypass all that hassle? Imagine having your downloadable Utah Bill of Sale form at your fingertips, ready to download instantly with just a click.The Utah Bill of Sale Form 2024, updated for the year 2024, serves as a legal document to document the transfer of a wide range of property - from vehicles and boats to personal belongings such as furniture or electronics - from a seller to a buyer. This form is essential for both parties as it not only offers proof of the transfer of ownership but also provides details on the condition and specific information about the item sold.How to Fill Out a Utah Bill of Sale Form

Form Utah Bill of Sale Form Instructions

Creating a Utah Bill of Sale is a straightforward process that provides legal documentation for the sale and purchase of personal property, such as vehicles, boats, firearms, or general items. This document is crucial for both the buyer and the seller as it serves as proof of transfer of ownership, details of the transaction, and can be used for registration and tax purposes. Here's a detailed guide on how to fill out a Utah Bill of Sale form, specifically tailored for users of Bluenotary, where the form can be easily downloaded.- Step 1: Download the Form

- Step 2: Fill in Seller and Buyer Information

- Step 3: Describe the Item Being Sold

- Step 4: State the Sale Details

- Step 5: Disclosures (If Any)

- Step 6: Signatures

- Step 7: Distribute Copies

- Accuracy is Key: Double-check all information for accuracy to avoid future disputes or legal issues.

- Understand Legal Requirements: Familiarize yourself with any specific Utah state requirements for the type of item you're selling.

- Notarization: While not always required, getting the document notarized can add an extra layer of legal protection.

- Digital Copies: Consider keeping a digital copy of the completed form for easy access and backup.

- By following these steps and tips, you can ensure that your Utah Bill of Sale form is filled out correctly and efficiently, providing a smooth and legally sound transaction for both parties involved.

Frequently Asked Questions

The Utah Bill of Sale form is a legal document that facilitates the recording of the transfer of ownership of personal property, such as vehicles, boats, firearms, or other items, from a seller to a buyer. It acts as proof of the transaction and provides comprehensive details about the item sold and the terms of the sale.

The Utah Bill of Sale form is primarily utilized to document the sale and purchase of personal property within the state of Utah. It safeguards both the buyer and the seller by offering a written record of the transaction, including specifics such as the description of the item sold, the sale price, and the date of the sale. This form may also be necessary for registration and tax purposes, particularly for vehicles and boats.

You can obtain the Utah Bill of Sale form for free from reputable sources such as the Utah Division of Motor Vehicles (DMV) website, legal document websites, or our website Blue Notary. It's crucial to verify that the form meets Utah state requirements.

Individuals or entities involved in the sale and purchase of personal property within Utah are required to fill out a Utah Bill of Sale form. This includes private sellers and buyers of vehicles, boats, firearms, and other personal items. The form is an essential document for the buyer to establish ownership and for the seller to keep a record of the sale.