Florida Insurance Affidavit Form Template

A Florida Insurance Affidavit Form is a formal document used to affirm that a vehicle owner has obtained the required insurance coverage in compliance with Florida law. To access our Florida Insurance Affidavit Form Template, designed to simplify the process of verifying your insurance status, click the button below. This template is essential for ensuring that your vehicle is legally insured and that you are in compliance with state requirements.

Save time, avoid headaches, and ensure compliance effortlessly with current version of Florida Insurance Affidavit Form Template. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Understanding the Template

How to Use the Template

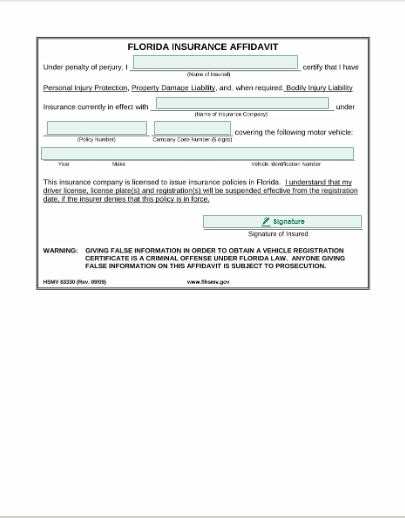

- Policyholder Information: Clearly state the full names, addresses, and contact information of the policyholder. Include driver's license number or identification card number if required.

- Insurance Details: Provide detailed information about the insurance policy, including the policy number, insurance company's name, effective dates of coverage, and the type of coverage provided.

- Vehicle Information: Record the details of the vehicle covered by the insurance, including the make, model, year, and vehicle identification number (VIN).

- Affirmation Statement: Include a statement affirming that the policyholder has the required insurance coverage in compliance with Florida law. Ensure this statement is clear and concise.

- Signatures and Date: Provide space for the policyholder to sign and date the form to indicate their affirmation of the insurance coverage. Include a statement indicating that the affidavit constitutes a legally binding declaration of insurance coverage.

Frequently Asked Questions

A Florida Insurance Affidavit Form is a formal document used to affirm that a vehicle owner has obtained the required insurance coverage in compliance with Florida law. It serves as a legally binding declaration that details the insurance policy information and verifies that the vehicle is insured according to state requirements.

Vehicle owners in Florida who need to verify their insurance status for registration, renewal, or other legal requirements should use the Florida Insurance Affidavit Form Template. This includes individuals, businesses, and organizations responsible for ensuring their vehicles are properly insured.

You can download the Florida Insurance Affidavit Form Template for free from reputable sources like our website BlueNotary or from the Florida Department of Highway Safety and Motor Vehicles (FLHSMV).