Thinking about becoming a notary in Florida? You're in the right place. It's a fantastic credential that serves the public and can open up some interesting professional doors. A lot of people get intimidated, thinking the process is buried in legal red tape, but it’s actually a pretty clear path if you know the steps.

This guide will walk you through the entire journey, from figuring out if you qualify to holding your official seal for the first time. We'll break it all down, no confusing jargon.

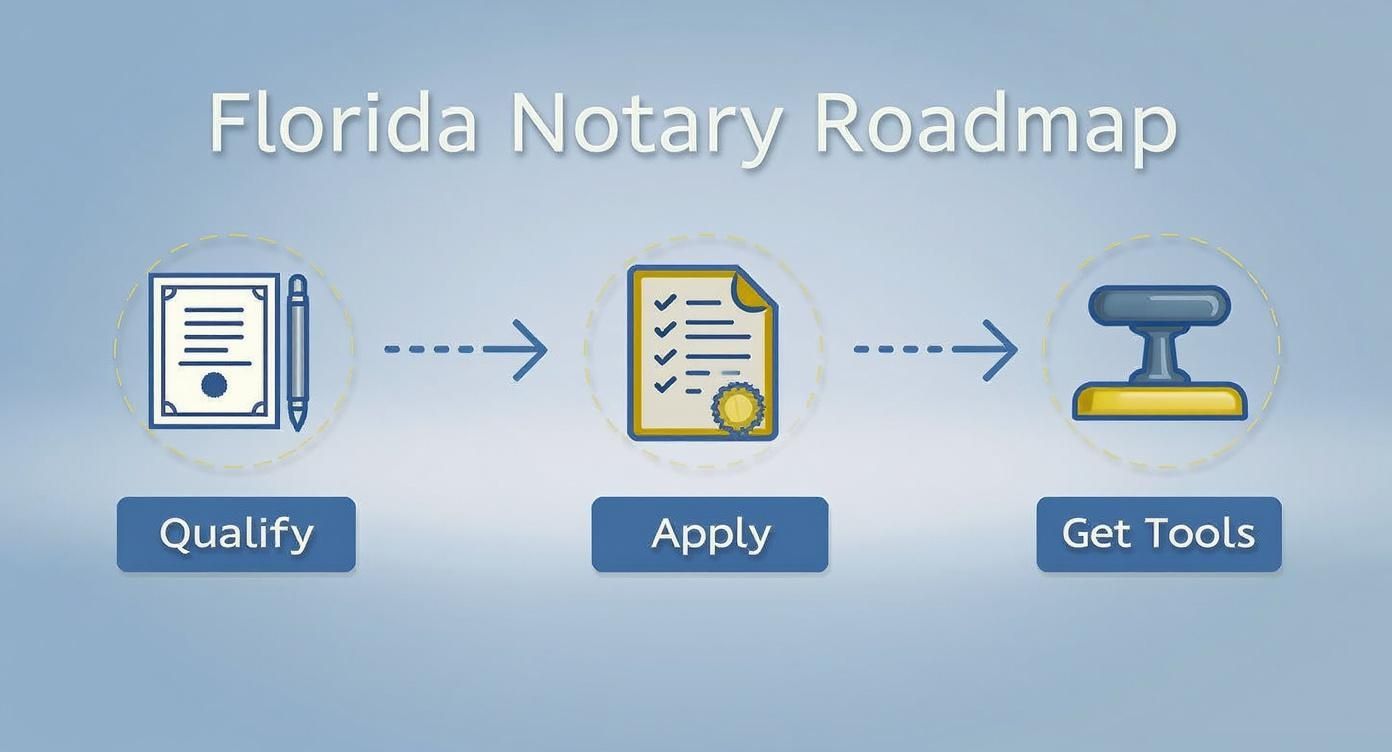

Your Florida Notary Commission Roadmap

The path to your notary commission is a series of milestones. Each one builds on the last, moving you steadily toward your goal. You'll start by making sure you meet the state's basic requirements before you even think about applications or tools.

This infographic gives you a bird's-eye view of the three main stages: Qualify, Apply, and Get Your Tools.

As you can see, it's a logical sequence. You have to complete each part in the right order before the state sends you that coveted commission certificate.

Understanding the Timeline and Costs

It helps to go in with a realistic picture of the time and money involved. The good news? Becoming a notary in Florida is surprisingly affordable, and the demand for notary services is always there.

Just to give you an idea, the Florida Division of Corporations recently approved over 18,000 new notary applications in a single year. That shows a real, steady need for qualified professionals. Even better, the total startup cost for a four-year commission, including your required bond and all the state fees, can be as low as $79. You can dig into more data on Florida notaries to see just how accessible this is.

To lay it all out from the start, here’s a quick summary of what you’re looking at.

Florida Notary Commission At a Glance

This table breaks down the essentials—the requirements, timeline, and what you can expect to spend to get commissioned.

| Requirement | Details | Estimated Cost |

|---|---|---|

| Eligibility | You must be 18+, a legal Florida resident, and have no felony convictions (unless your civil rights have been restored). | $0 |

| Education Course | You'll need to complete a state-approved 3-hour notary course from a certified provider. | $20 – $50 |

| Application & Bond | This involves submitting your application along with a $7,500 surety bond. | $39 – $100 (for the combined bond + fees package) |

| Notary Seal | You have to purchase a state-compliant seal (either a stamp or an embosser) with your commission info. | $20 – $40 |

| Total Timeline | From the day you apply to receiving your commission, the whole process usually takes just 2-4 weeks. |

It’s a manageable investment for a four-year commission that empowers you to perform a vital public service.

First Things First: Your Eligibility Checklist and Training

Before you even think about applications, bonds, or fancy notary seals, let's pump the brakes. The absolute first step is making sure you actually qualify to be a notary in Florida. These aren't just suggestions from the state; they're hard-and-fast rules. Getting this part right saves you from wasting time and money on an application that’s dead on arrival.

Think of this as the gatekeeper to the whole process. You have to get past this before moving on.

Florida's Core Eligibility Checklist

This is non-negotiable. You need a confident "yes" for every single one of these points before you can even touch an application.

- Age Requirement: You must be at least 18 years old.

- Residency Status: You have to be a legal resident of Florida. Good news is, you don't have to be a U.S. citizen, but you absolutely must reside in the state legally.

- Language Proficiency: You must be able to read, write, and understand English. This is critical for making sense of legal documents and filling out notarial certificates correctly.

Those first few are pretty straightforward for most people. The next one, though, is where you need to pay close attention.

Understanding the Felony Conviction Rule

Florida law is clear: you cannot have a felony conviction. But—and this is a big but—there's a crucial exception. If your civil rights have been officially restored after the conviction, you're back in the game and eligible to become a notary.

This is a really important distinction. Just finishing your sentence isn't enough. You must have gone through the formal legal process of rights restoration. If this is your situation, be prepared to provide the official paperwork proving it when you apply.

Key Takeaway: A past felony doesn't automatically shut the door. If you have official documentation showing your civil rights have been restored, you're good to go. Just make sure you have that proof ready to submit.

Knocking Out the Mandatory Notary Education Course

Once you've ticked all the eligibility boxes, it's time for the mandatory three-hour notary education course. This isn't just busywork; it's your boot camp for becoming a notary. Every first-time applicant has to take this course from a state-approved provider.

The course is designed to give you the foundational knowledge to do your job correctly and ethically from day one. It's built on principles of competency-based training, meaning it’s structured to make sure you can handle real-world situations, not just pass a test.

You’ll get the rundown on:

- The legal duties and—just as important—the limitations of a Florida notary.

- Proper procedures for identifying signers and administering oaths.

- The right way to use your notary seal and fill out certificates.

- A primer on electronic notarization and its unique set of rules.

- Ethics and best practices to protect both yourself and the public.

Honestly, this training is your best defense against making a costly mistake. For instance, do you know the difference between taking an acknowledgment and administering an oath? They sound similar, but they're fundamentally different acts. The course will hammer these distinctions home so you don't get tripped up.

Picking the right course provider matters. Find a state-approved vendor that works for your learning style, whether it’s a self-paced online course or a live webinar. Many bonding agencies bundle the course into a complete notary package, which is a great way to simplify everything. This initial training is just the beginning, and if you're thinking about specializing later, our guide on becoming a loan signing agent shows you what other educational paths you can take.

Getting Your Application and Notary Bond in Order

Alright, you’ve passed the training course and confirmed you're eligible. Now for the official paperwork. This is where you need to slow down and pay close attention to the details. A tiny mistake on your application can send you right back to the starting line, which is incredibly frustrating.

This part of the journey has two main pieces: filling out the application itself and getting your notary surety bond.

Let's talk about the bond first. Think of it as a special kind of insurance policy, but it's not for you—it’s for the public. If you make a mistake that costs a client money, this bond is there to make them whole.

What Exactly Is a Florida Notary Bond?

Florida law is very clear on this: every notary has to have a $7,500 surety bond for their entire four-year term. It’s basically an agreement between you, the State of Florida, and the company that issues the bond.

Don't let the $7,500 number scare you; you won't be paying anywhere near that. You buy the bond from an approved agency for a small premium, and it's almost always bundled into a package that covers your application fees, too.

This bond is a critical safety net. Imagine you accidentally notarize a forged signature on a property deed. If that leads to a fraudulent sale, the real owner could file a claim against your bond to recover up to $7,500 in damages.

How to Choose a Bonding Agency

Honestly, the simplest way to handle both the application and the bond is through a state-approved bonding agency. These guys are the pros; they do this all day, every day. Many of them offer packages that roll everything into one fee, which usually includes:

- The required notary education course.

- The $7,500 surety bond.

- State application filing and associated fees.

- Your official notary seal and a journal for keeping records.

For anyone doing this for the first time, I can't recommend this route enough. It practically eliminates the chances of making a costly error on your paperwork.

Pro Tip: Look for an agency that offers more than just the basics. Good ones provide ongoing education and support. As you get more experienced and maybe decide to go into remote services, having a reliable partner to ask questions is a huge plus. You can see how this foundation connects to the next level when you register as a Florida online notary public.

Filling Out the Official Application

The application form itself isn't complicated, but it demands precision. You’ll need to put down your full legal name exactly as you want it on your commission, along with your addresses and contact details.

One of the most critical sections is the Oath of Office. When you sign this, you're legally swearing to follow Florida's laws and perform your duties faithfully. It’s a big deal—this oath is the legal backbone of your entire commission.

You’ll also need to get a character witness to sign your application. This needs to be someone who isn't related to you but knows you well enough to vouch for your integrity.

Putting It All Together

Once the application is filled out and your bond is secured, it's time to assemble the whole package. Double and triple-check that you have everything before it gets sent off. A missing document is an automatic rejection.

Here’s your final checklist:

- The Completed Application: Signed by you and your character witness.

- The Certificate of Course Completion: Your proof of passing the mandatory three-hour training.

- The Original Surety Bond: The official document from your bonding agency.

- The State Filing Fee: This is currently $39. If you use a bonding agency, you'll pay them, and they’ll pay the state on your behalf.

Your bonding agency will usually handle the actual submission. They give everything one last look-over to catch any potential red flags, which is another great reason to use one.

Now comes the waiting game. It typically takes about two to four weeks for the state to process everything and for the Governor's office to officially issue your commission. Once that's done, you'll get your commission certificate in the mail, and you'll be ready to start your work as a Notary Public for the State of Florida.

Getting Your Official Notary Seal and Journal

That envelope from the Governor's office finally arrives, and inside is your commission certificate. Congratulations, you are officially a Notary Public for the State of Florida! But hold off on notarizing just yet. Before you can perform your first official act, you need the essential tools of the trade: your official seal and a reliable record-keeping journal.

These items aren't just accessories; they are non-negotiable requirements for your role and your own personal protection. Your notary seal is your unique, official signature—it’s the mark that proves a notarization was performed by you. Think of it as your professional fingerprint on every document you touch.

Decoding Florida's Notary Seal Requirements

Florida has very specific, non-negotiable rules for your notary seal. Getting this wrong is a huge deal—any notarization you perform could be invalidated. So, precision is everything.

Your seal must be a rubber stamp that uses black ink only. The impression has to be crystal clear and easy to photograph or scan. Most importantly, it must contain these four pieces of information:

- Your Name: Exactly as it appears on your commission certificate. No nicknames, no variations.

- The Words "Notary Public – State of Florida": This exact phrase is required.

- Your Commission Number: This is the unique ID the state assigned to you.

- Your Commission Expiration Date: The day your four-year term ends.

The responsibility falls on you to make sure the vendor creating your stamp gets all this information perfect. A common pitfall for new notaries is buying an embosser instead of a rubber stamp. While an embosser looks official, it can only be used in addition to your ink stamp, never as a substitute.

Choosing Your Notary Stamp

When you go to order your seal, you'll mainly see two options: a traditional stamp with a separate ink pad or a self-inking stamp.

Take it from someone who's been there—for day-to-day use, the self-inking models are vastly superior. They give you a crisp, clean impression every single time and are much easier to toss in a bag if you plan on doing any mobile notary work.

Expert Insight: Always order your seal from a reputable vendor specializing in notary supplies. They know Florida's legal requirements inside and out and are far less likely to make a mistake on the text or format, which will save you a massive headache later on.

The Case for a Meticulous Notary Journal

Now for a piece of advice I can't stress enough: always keep a detailed notary journal. While Florida law doesn't technically require you to log every traditional, in-person notarization, not doing so is one of the biggest risks you can take.

Your journal is your single best piece of evidence if a notarization is ever questioned or challenged in court.

Think of your journal as the complete story of each notarial act. It proves you followed procedure, properly identified the signer, and did your job correctly. Without it, you’re left relying on your memory, which simply won't hold up if things get serious.

For every single entry, you should be meticulously recording these details:

- Date and Time of Notarization: Get as specific as you can.

- Type of Notarial Act: Was it an acknowledgment, jurat, oath, etc.?

- Document Title or Description: For example, "Power of Attorney for John Smith" or "Deed of Trust for 123 Main St."

- Signer's Full Name and Address: Exactly as it appears on their ID.

- Method of Identification: Note the type of ID (e.g., Florida Driver's License), its number, and its expiration date.

- Signer's Signature: Have the client sign your journal right next to their entry.

- Fees Collected: Keep a clear record of any fees you charged.

- Additional Notes: Was anything unusual about the signing? Note it here. This is your space to add important context.

This record is your professional shield. Keeping it diligently is the hallmark of a responsible notary and provides peace of mind for both you and the public you're sworn to serve.

Understanding Your Duties and Building Your Business

https://www.youtube.com/embed/hDV76CDxrYc

Getting that Florida notary commission in your hands is a huge milestone, but it's really just the beginning. You're now a public official entrusted with a serious responsibility. This job is so much more than just stamping paper; you're on the front lines of fraud prevention, verifying identities, and ensuring that crucial transactions have integrity.

This role comes with very specific duties and, just as importantly, some very clear legal boundaries you can't cross. Knowing the difference is what separates a professional notary from someone who's putting their commission—and their clients—at risk.

Your Primary Notarial Responsibilities

As a Florida notary, you're authorized to perform a handful of key acts. You'll probably do some more than others, but you need to be ready to handle any of them correctly according to state law.

- Administering Oaths and Affirmations: This is when you formally ask a signer to swear or affirm that what they're putting in a document is the absolute truth. Think of someone signing a court affidavit—your act gives their statement legal weight.

- Taking Acknowledgments: With an acknowledgment, you're certifying a few key things: the person appeared before you, you properly identified them, and they signed the document of their own free will. This is incredibly common for documents like a Power of Attorney.

- Solemnizing Marriages: That's right—in Florida, notaries can officiate weddings! It's a unique part of the job that many notaries build into a rewarding and specialized service.

You also have the authority to attest to photocopies of certain documents and verify Vehicle Identification Numbers (VINs). Every single one of these acts requires a specific notarial certificate, so you have to know which one fits the situation.

Lines You Can Never Cross

Knowing what you can't do is just as vital as knowing what you can. Overstepping your authority is the quickest way to lose your commission and find yourself in legal hot water. The golden rule is simple: you are not an attorney.

Critical Reminder: You are strictly forbidden from giving legal advice. That means you can't help someone pick which document to use, tell them how to fill out a form, or explain the legal consequences of what they're signing. This is the unauthorized practice of law, and Florida takes it very seriously.

Your job is to handle the notarization itself, period. If a client starts asking for legal guidance, the only right answer is to advise them to speak with a qualified lawyer. It protects them, and it protects you.

Turning Your Commission Into a Business

While your core duty is to serve the public, your commission is also a fantastic opportunity to build a business. The income potential for Florida notaries has grown quite a bit, especially with the rise of mobile and remote services. Many notaries are now pulling in $1,000 to $2,000 a month just working part-time.

Here's a look at the fee structure and how you can earn.

Florida Notary Fee Schedule and Services

The state of Florida sets the maximum fees you can charge for notarial acts. While the traditional fee is capped, remote online notarization offers a higher earning potential per act, reflecting the technology and convenience involved. This table breaks down the basics.

| Notarial Act | Maximum Fee (Traditional) | Maximum Fee (Remote Online) |

|---|---|---|

| Oaths or Affirmations | $10 per individual oath/affirmation | $25 per notarization |

| Acknowledgments | $10 per certificate | $25 per notarization |

| Attesting to a Photocopy | $10 per certificate | $25 per notarization |

| Solemnizing a Marriage | $30 | N/A |

| Verifying a VIN | $20 | N/A |

Understanding this fee schedule is the first step, but the real money is made by adding value through convenience and specialization.

The ability to charge more for remote notarizations has been a game-changer. Mobile notaries also boost their income by charging travel fees on top of the state-mandated fee, which is perfectly legal as long as it's disclosed separately. This is a huge benefit for clients in the real estate and legal sectors who need you on-site.

Another lucrative path is becoming a Loan Signing Agent (LSA). As an LSA, you're a notary who specializes in walking borrowers through mortgage closing documents. Because you bring expertise to a complex process, you can earn much more per appointment—often between $75 and $200.

Platforms like BlueNotary have opened up even more doors. By getting your remote online notarization (RON) certification, you can connect with clients all over the country without ever leaving your home office. This allows you to offer your services 24/7, dramatically expanding your client base and business potential.

Got Questions? Let's Get Them Answered

Even with the best roadmap, you're going to hit a few confusing intersections. That's perfectly normal. Think of this as your personal Q&A session, where we tackle the most common questions and "what-if" scenarios that pop up for new notaries.

We’ve seen these sticking points trip people up time and time again, so let's clear the air and make sure you feel confident moving forward.

Can I Notarize for My Family?

This is easily one of the first questions every new notary asks. While Florida law doesn't have a hard "no" on notarizing for relatives, it's a practice you should almost always avoid. Why? It all comes down to impartiality.

You are strictly forbidden from notarizing any document where you have a direct financial or beneficial interest. Let's say you notarize your spouse's signature on a car loan for a vehicle you'll both be driving. That's a textbook conflict of interest and a huge red flag. The cleanest, safest approach is to just say no to family notarizations. It protects you and maintains the integrity of your commission.

What Happens If I Move to a Different County in Florida?

Good news: your notary commission is valid across the entire state of Florida. A move from Miami to Tampa doesn't invalidate your ability to notarize. You won't have to start the application process over.

You do, however, have to let the Department of State know you've moved. Your bonding agency can usually handle this for you, which is a nice perk. They'll get your official records updated so everything stays current.

Key Takeaway: Your commission is statewide. Your physical address within Florida doesn't limit where you can perform your duties. Just keep the state in the loop about where you are.

Do I Really Need Errors and Omissions Insurance?

Let's be clear about the $7,500 surety bond: it protects the public, not you. If you make a mistake that causes financial harm and a claim is paid out from that bond, the surety company will turn to you to get that money back.

That's where Errors & Omissions (E&O) insurance becomes your safety net. E&O is a separate policy designed to protect you and your personal finances. If you're sued over an honest mistake, it covers your legal bills and potential claim payouts. It’s not required by Florida law, but walking into this profession without it is a risk I wouldn't recommend to anyone.

Staying on Top of Fees and Legal Changes

The rules of the road for notaries can and do change. A recent bill passed by the Florida Senate, for example, brought in new rules to fight fraud and clarified a notary's core duties. It's your job to stay informed. A good starting point is to review official summaries, like this one from the Florida Senate's official analysis, to see what's new.

The state also sets firm caps on what you can charge:

- $10 is the maximum for any single traditional notarial act.

- $25 is the cap for a remote online notarization (RON).

- $30 is the fee you're allowed to charge for solemnizing a marriage.

Always be upfront about your fees with clients, and be ready to provide an itemized receipt if they ask for one.

What's the Difference Between an Acknowledgment and a Jurat?

Getting this right is fundamental to your job, but it's a common point of confusion for newcomers. The document itself will tell you what's needed, so you never have to guess.

- Acknowledgment: The signer simply needs to appear before you and acknowledge that they signed the document willingly. They could have signed it last week; the key part is them confirming their signature to you in person.

- Jurat: The signer absolutely must sign the document in your physical presence. After they sign, you'll administer an oath or affirmation, where they swear that the information in the document is true.

The certificate wording is your guide. Your role isn't to choose the act but to correctly perform the one that's requested on the document.

Ready to unlock a bigger client base? With BlueNotary, you can take your commission online and serve clients across the country, any time of day. Our secure platform gives you the training, tech, and client flow to build a thriving, flexible notary business right from your home. Launch your online notary career with BlueNotary today!