Negotiating the field of financial transactions is frightening for many people, especially while executing the transfer of securities. The medallion signature guarantee stamp is one significant feature used to ascertain the safety of these kinds of transactions. More specifically, it is proof of the validity of the signatures of the sale or transfer of securities documents, and that provides the necessary protection against the fraudsters who might wish to access the securities without the owners’ knowledge of the changes.

The concept of the medallion signature guarantee stamp and its acquisition are not completely understood by those who are not in the know. Whether you are the one transferring stocks, bonds, or mutual funds, mastering the whole procedure should definitely be on your to-do list if you want the process to be a walk in the park. In this post, we will expose the meaning, relevance, and the process of obtaining a medallion signature guarantee stamp.

What Is A Medallion Signature Guarantee Stamp?

A medallion signature guarantee stamp affirms the truth of the person’s signature on the financial transaction documents.

Only financial bodies like banks, credit unions, and other institutions from the Securities Transfer Agents Medallion Program (STAMP), Stock Exchanges Medallion Program (SEMP), and the New York Stock Exchange Medallion Signature Program (MSP) give out these certifications.

They make sure that the signature specified on transferable properties like a stock, bond, or mutual fund certificate is original and comes from the true owner.

The security features embedded in the medallion signature guarantee stamp are what make it unforgeable. These features consist of number sequences which are unidentifiable thus, they can only be confirmed electronically by the relevant financial institutions. A financial guarantee granted by the institutions certifies the validity of the stamp which in turn means the process of stamping is strictly watched and controlled.

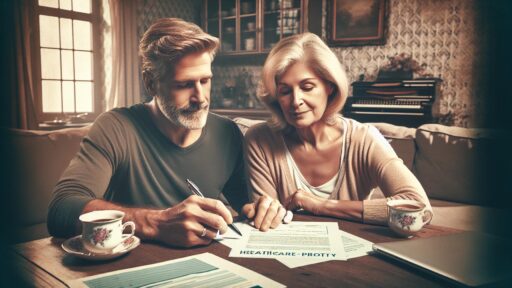

A medallion signature guarantee may be required by an individual whenever they are dealing with various transactions involving large assets of high value. For instance, they may include such instances as moving equities to a new broker, shifting investment ownership or sell bonds. This stamp is a move to stop fraudulent activities and makes it necessary for the identity of the participants in the operations to be personally verified before it is admitted.

People usually get a medallion signature guarantee stamp by visiting a bank or credit union with the appropriate identification and documents. This service isn’t offered by all of the financial institutions so, it is vital to communicate with the institution in question. The person needing the stamp has to bring with them a bank book, if possible, and a list of all necessary documents that are required by the institution.

Role Of A Medallion Signature Guarantee Stamp

A medallion signature guarantee stamp contributes largely to the establishment of financial transactions, making the signatures real and authentic. It is specifically vital for the transactions that involve securities such as stocks, bonds, and mutual funds.

Ensures The Safety Of The Transaction

The medallion signature guarantee stamp acts as a barrier between the swindler and the swindled by positively guaranteeing the authenticity of their signatures as well as the financial make and model of the returned documents. Reliable financial corporations like banks and credit unions are appointed to distribute and protect the stamp, and, also, counterfeit protection provisions are clothed at the same time. When the institution gives a warranty of a signature, it is the one that holds the financial liability if any fraud is committed; thus, the entire transaction is also secured.

Facilitates Secure Financial Transactions

Through the process of signature validation, this stamp simplifies the task of secure financial transactions routing, which becomes critical if the ownership of documents of value has to be changed. The device performs the function of only allowing rightful people to do the transferring of stocks, thus minimizing the risk of unauthorized transactions. A person who wishes to get this stamp will generally need to execute the procedure of identification and the paperwork and have an account with the issuing institution. This demand certifies that the person has been checked by the organization for identity, which adds safety to the deal.

How To Obtain A Medallion Signature Guarantee Stamp

One of the ways of acquiring a Medallion Signature Guarantee Stamp is made up of several stages. To do so, people have to meet eligibility conditions and collect necessary documentation.

Eligibility Requirements

In order to be eligible, individuals need to open an account with the establishment that is supplying the seal. The provision of this service is generally reserved for the customer base of banks, credit unions, and other financial institutions. The deemed requirement of eligibility via the risk management policy of the institution often implies that customers need to show a reasonable period of account standing or reach a certain balance of the account.

Necessary Documentation

Applicants have to show a valid ID. Valid IDs can be either a driver’s license, passport, or state ID. It is also possible that the institution will want the social security card to be one more proof of the applicant’s identity. Required are the securities being transferred, evidence of ownership, and transaction instructions. Institutions may want to verify account status by asking to view a current statement. The signing officer may ask for the signature to be notarized as an extra umbrella against fraud.

Where to Get a Medallion Signature Guarantee Stamp

Customers looking for a medallion signature guarantee stamp have a number of options. This kind of service is typically rendered by banks, financial institutions, and credit unions.

Banks and Financial Institutions

Most medallion signature guarantee stamps are provided by banks as well as financial institutions. People who have accounts at these institutions can ask for a stamp by visiting a branch that offers the service. The presence of confirmation is generally needed when a person wants to receive the guarantee. The customer has to be ready with pieces of documents like a driver’s license in cases where he/she is required to prove his/her identity. Moreover, further evidence such as the person’s account statement or a piece of securities ownership may be demanded to conclude the procedure. The Securities Transfer Agents Medallion Program (STAMP) claims that not all of the branches execute this service, meaning it is wiser to check with them ahead.

Credit Unions

Medallion signature guarantee stamps can as well be picked up by members at their local credit unions. Such institutions require their members to have an existing account and valid identification, just like banks. Additionally, individuals may need to produce their recent account statements just to be sure and a paper showing their ownership of the securities. The availability of this service often differs from one place to another, so members are advised to make an inquiry at their neighborhood branch to ascertain the current state of things.

Problems In Getting A Medallion Signature Guarantee Stamp

Acquiring a medallion signature guarantee stamp can be quite a task. By knowing these hitches, a person can be well prepared to clear at least one obstacle and perform the process more efficiently.

Limited Availability

Finding a branch that provides the medallion signature guarantee stamp with no trouble at all is not an easy task as not all banks and credit unions give this service. In many cases, people must go to the bigger branches or specific locations in order to have their work done. An individual should check the bank or credit union’s policy first to avoid unnecessary hassle. Not to mention that a lot of financial institutions only allow a certain account type or that the service is available only for their high-value customers.

Stringent Verification Processes

The procedure for obtaining the seal includes a very thorough verification process. The person who applies bears the responsibility of procuring valid identification as well as essential papers. Often, the documents the applicant must produce are ownership proof of the securities, the most recent account statements, and a statement that is signed/notarized if necessary. The organizations’ checks are aimed at covering all aspects and limit the possibilities of fraud, which in return slows down the process.

Discover the Power of BlueNotary:

Integrate your Business, Title Company, or Law Firm to Satisfy your Customers and Decrease Turnaround

Get a document Notarized/Sign-up

Join the Free Notary Training Facebook Group

Conclusion

It is a must for all stockholders in the securities business to be familiar with the meaning of the medallion signature guarantee stamp. The stamp is used as a guarantee against the unauthorized transfer of the money thus reducing the financial fraud risk. The process of acquiring it is pretty clear which means that one has to meet the required specifications and the necessary documents should also be attached before.

Yes, to protect the financial assets during transactions of high value and not only in the typical transfer processes, individuals should first contact the financial firms to be sure the service is available, meet the requirements of the institution, and finally obtain the medallion stamp. The process of getting a medallion signature guarantee stamp is, of course, the main part to eliminate fraudulent activities in committing to high-value. Despite the major obstacles, this still applies as one of the most important aspects to consider when one decides to get a medallion signature guarantee stamp.

Frequently Asked Questions

What is a medallion signature guarantee stamp?

A medallion signature guarantee stamp confirms the validity of signatures on financial documents, for instance, that of shares of corporate stock or corporate bonds, debentures, or mutual funds. It is given by the financial institutions that are authorized to do so along with certification to the customer that the transaction is legitimate and not fraudulent.

Why do I need a medallion signature guarantee stamp?

Obtaining a medallion signature guarantee stamp is a kind permission that the person who signs the document is exactly who he says he is and that he can afford to invest a certain amount of money in the bank. This is necessary for securities that are fraud-resistant and can’t be handled by unauthorized people or robots. Thus, it protects the securities and the investments even those that are of high value and are thereby quite precious to the owner.

Where can I get a medallion signature guarantee stamp?

One can get the medallion signature guarantee stamp from a stockholder, a credit association, etc. Also, you can check with your credit union or the institution itself. It is usually offered where you have your account open, but do not bank on it because not all of them will give you the service, so ring up first.

What documents do I need to get a medallion signature guarantee stamp?

In case you want to get a medallion signature guarantee stamp, you must carry a photo ID with you (a driver’s license or passport will do). Also, you will be required to fill out several forms of the institution, such as power of attorney or the like, for the formalization of the transaction. To get a medallion signature guarantee stamp, one very necessary and the only document to be taken is your identification proof, it could be a driver’s license, or any other official document.

Attribution required for a medallion signature guarantee. The process is quite similar to that of getting a notarized statement. You must have a valid ID available as proof of your identity (e.g., a driver’s license, identification card or passport) and proof of the ownership of the securities you want to transfer. It is also advisable to bring a recent account statement with you, although not every institution may require one. Some institutions may also request a notarized signature.

Are there any eligibility requirements for obtaining a medallion signature guarantee stamp?

Indeed, the usual way of acquiring a medallion signature guarantee stamp is to have an account with the concerned institution, which you can prove in the event of a request. Usually, this service is available only to their customers, and these institutions will only help certain account holders or high-profile clients.

Can all branches of my bank provide a medallion signature guarantee stamp?

Unfortunately, it is not possible for all branches of your bank to provide a medallion signature guarantee stamp. To be sure, it is best to check with your local branches if the service is offered, as it is generally limited to a few larger or specific locations.

Are there any challenges in getting a medallion signature guarantee stamp?

Definitely, the process of getting a medallion signature guarantee stamp is associated with a couple of challenges. These include finding a branch equipped with the service, complying with the strictest verification requirements, and providing the necessary documents in time, among others. Apparently, inadequate planning of this process can lead to delays.

Is a medallion signature guarantee stamp the same as a notary stamp?

No, the service of a medallion signature guarantee stamp is the opposite of a notary stamp. The medallion signature guarantee certifies the authenticity of signatures on financial papers concerning securities alone, while the notary stamp establishes the identity of the signer for any purpose/document.