So, what exactly is a mortgage promissory note? Think of it as the official, legally binding "I owe you" for your home loan. It’s the signed document where you, the borrower, make a personal and direct promise to repay the money you borrowed.

This note is a completely separate document from the mortgage or deed of trust, and that’s a critical distinction. While the mortgage secures your promise by tying the debt directly to your property, the promissory note is what creates the financial obligation in the first place.

The Foundation of Your Home Loan

At its core, a mortgage promissory note is a simple concept with some serious legal muscle behind it. It’s the black-and-white proof of the debt you owe the lender.

The note is what makes you personally liable for paying back every penny of the loan. This is a big deal. For instance, if the property's value were to drop and a foreclosure sale didn’t cover the entire loan amount, the promissory note is often the legal tool that allows the lender to pursue you for that remaining "deficiency" balance.

Why This Document Matters So Much

Getting this document right is non-negotiable for everyone sitting at the closing table. For borrowers, it lays out the precise terms of their financial future. For lenders, title companies, and investors, a properly executed note is the only thing that makes a loan enforceable.

The promissory note is the star witness in any potential foreclosure. Without a valid, signed note, a lender has a tough, uphill battle trying to prove they have the legal right to collect the debt or reclaim the property.

To really appreciate the modern promissory note, it's helpful to see just how home loans have evolved over the years. The specific language and clauses you see in today’s notes are the product of decades of financial innovation and legal precedent.

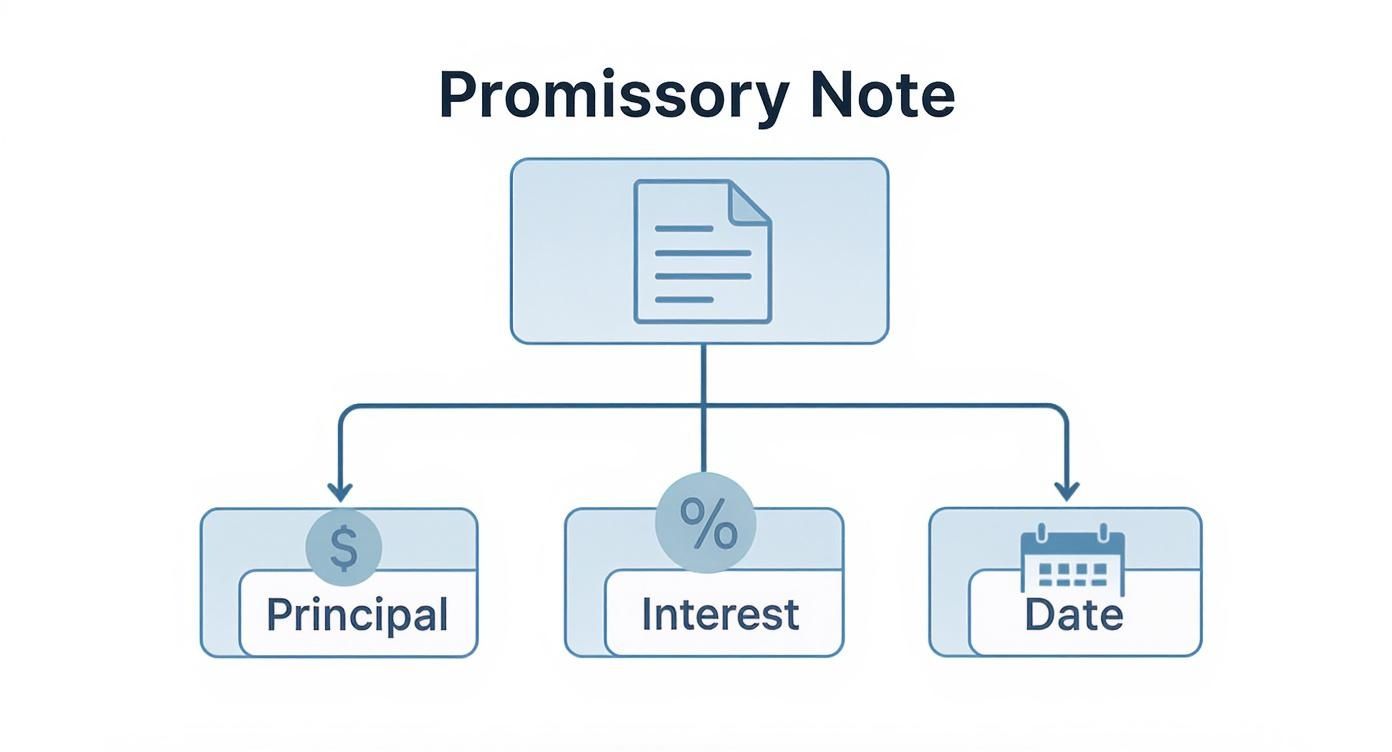

So, what gives the note its power? It boils down to a few key ingredients:

- The Unconditional Promise to Pay: Crystal-clear language stating the borrower will repay the loan.

- The Principal Amount and Interest Rate: The exact financial DNA of the debt.

- The Payment Schedule: The roadmap for when payments are due and how they're applied.

- The Borrower’s Signature: The final act that locks in the promise and makes it all legally binding.

In this guide, we're going to pull back the curtain on every part of a mortgage promissory note, from decoding its most important clauses to mastering modern eClosing methods. Whether you're looking for a basic promissory note template or need to get up to speed on the details of remote online notarization, you’ll walk away with the confidence to handle your next real estate transaction like a pro.

Decoding the Key Clauses in Your Note

A mortgage promissory note is way more than a formality; it’s the financial blueprint for your home loan. Every single clause has a specific job, laying out the rights and responsibilities for both you and the lender. When you understand these terms, you go from being just a signer to an empowered homeowner.

Think of the note as the loan’s DNA. It holds the unique code that spells out how the debt will be repaid, what happens if you’re late, and the total cost of borrowing money over the years. Getting a handle on this code is your first real step toward taking financial control.

The Core Financial Components

At the very heart of the note are the numbers. These clauses are the most straightforward, but they also have the biggest impact on your wallet.

- Principal Amount: This is your starting line—the exact amount of money you borrowed. It’s the original loan balance before a single cent of interest gets added or any payments are made.

- Interest Rate: This is the cost of borrowing that principal, shown as a percentage. It’s what you pay the lender for the privilege of using their money, and it directly shapes your monthly payment.

- Maturity Date: This is the finish line. It's the final date by which the entire loan, including all principal and interest, must be completely paid off.

These three elements form the basic skeleton of your loan. But the real meat on the bones—the details of how it all works—is found in the other clauses.

Understanding Your Repayment Structure

Beyond the big numbers, the note gets into the nitty-gritty of your payments. This is where the loan's rulebook is written, covering everything from your monthly obligation to the penalties for slipping up.

A huge piece of this is the amortization schedule. This isn't just a simple payment calendar; it’s a detailed map showing how every monthly payment gets split between interest and principal. At the beginning of the loan, most of your payment is eaten up by interest. Over time, that balance slowly tips, and more of your hard-earned money starts chipping away at the principal.

Another key piece is the interest rate structure. A fixed-rate note means your interest rate is locked in for good, giving you predictable and stable monthly payments. On the other hand, an adjustable-rate mortgage (ARM) note has an interest rate that can change over time, meaning your payments could go up or down.

The terms in these notes have changed dramatically over the decades, often mirroring what's happening in the wider economy. The history of promissory notes is tied directly to big shifts in the financial markets. For example, the average 30-year fixed mortgage rate in the U.S. shot above a staggering 18% in the early 1980s but then dropped to historic lows near 3% in the 2010s. Those swings completely changed the deals lenders were putting on the table. You can dive deeper into these global interest rate trends to see how different countries stack up.

Key Clauses and Their Real-World Impact

Let's cut through the legalese. To really get what these clauses mean, you have to see them in action. This table breaks down the most common components you'll find in a mortgage promissory note and, more importantly, why they matter to you.

| Key Clauses in a Mortgage Promissory Note Explained |

| :— | :— | :— |

| Clause | What It Is | Why It Matters |

| Late Fee Clause | Spells out the penalty you'll pay and the grace period you have for making a payment after it's due. | This clause hits your wallet directly if you miss a deadline. Knowing the exact terms can save you from expensive fees. |

| Acceleration Clause | Gives the lender the right to demand you pay the entire loan balance immediately if you default on the loan. | This is the lender's big red button. It's the legal trigger that often kicks off the foreclosure process. |

| Prepayment Clause | Lays out the rules on whether you can pay off the loan early and if there are any penalties for doing so. | If you plan to sell, refinance, or just pay extra, this clause determines if you'll have to pay a fee for the privilege. |

| Default Clause | Clearly defines what actions (like missing payments) legally count as a "default" on your agreement. | This one is critical. It sets the specific conditions that allow the lender to take serious legal action against you. |

When it's all said and done, a well-written promissory note is crystal clear. There's no room for guessing games.

Every single clause is designed to create an airtight contract. It protects the lender’s investment while spelling out the borrower's exact obligations in black and white.

Promissory Note vs Mortgage Deed Explained

When you close on a home, you're going to sign a mountain of paperwork. Tucked inside that stack are two of the most critical documents you'll encounter: the mortgage promissory note and the mortgage deed (or deed of trust). People often mix them up, but they have completely different jobs.

Getting a handle on what each one does is key to understanding the legal nuts and bolts of your home loan.

Let's break it down with an analogy. Think of the promissory note as your personal "I promise to pay you back," and the mortgage deed as the "security system" linking that promise directly to your new house. They're separate legal papers, but they have to work together to create a loan that's actually secured by real estate.

The Promissory Note: Your Personal IOU

At its core, the promissory note is a simple but powerful financial contract. It's your direct, personal vow to repay a specific sum of money to the lender, all based on terms you've both agreed upon. This is the document that actually creates the debt.

The note is basically a standalone IOU. It spells out all the financial details: the loan amount, the interest rate, when your payments are due, and when the loan fully matures. Critically, this document makes you, the borrower, personally liable for the entire loan amount, no matter what happens to the home's market value down the road.

The Mortgage Deed: The Property's Collateral

So if the note is the promise, what’s the mortgage? The mortgage (or deed of trust, depending on your state) is the muscle behind that promise. This document isn't about financial terms; its one and only job is to secure the loan by placing a lien on your property.

That lien gives the lender a legal claim to your home until the debt from the promissory note is paid off completely. It’s the "security" in a secured loan. The mortgage is what gives the lender the legal green light to start foreclosure if you break the promise laid out in the note.

Without a mortgage deed, the lender would only have an unsecured loan—not much different from credit card debt—and wouldn't have the right to take your home if you stopped paying.

The note creates the debt; the mortgage secures it. One document establishes your financial obligation to repay the loan, while the other ties that obligation to a tangible asset your home. This two-part system protects the lender's investment and defines the borrower's responsibilities.

This infographic really simplifies the key parts of a promissory note, zeroing in on the essential terms that make up your promise to pay.

As you can see, the note is all about the money—how much, at what rate, and for how long. The mortgage deed, on the other hand, only cares about the property itself as the collateral.

These documents are separate, but in any real estate deal, they're inseparable. Lenders need both a valid note and a properly recorded mortgage to have a loan that's both secured and enforceable. The entire closing process, from signing to notarization, depends on executing these two distinct documents perfectly. It's a challenge modern solutions are designed to solve, which you can learn more about in our guide to eClosing for real estate. A digital approach ensures both the note and the mortgage are handled with the precision and legal compliance they demand.

How Promissory Notes Are Signed and Notarized

A mortgage promissory note is just a piece of paper until it's properly signed and notarized. This final step, known as execution, is what breathes legal life into the document, transforming a simple promise into an enforceable contract. It’s the moment of truth where the borrower formally accepts their debt obligation.

The whole signing process boils down to two core principles: identity verification and voluntary agreement. A notary public acts as a neutral, state-licensed witness to make sure the person signing is who they say they are, and that they're doing it willingly—no funny business, no coercion.

This official act gives the note its legal teeth. If a dispute or default ever happens down the road, that notarized signature is critical evidence. Without it, a lender’s ability to enforce the loan terms is on shaky ground.

The Traditional Notarization Process

For decades, executing a promissory note meant one thing: getting everyone in the same room. The borrower, a lender representative, and a notary would huddle around a table with a stack of papers and a pen.

In this classic setup, the notary has a few key jobs:

- Verifying Identity: This means carefully checking a government-issued ID, like a driver's license or passport, to confirm the signer is legit.

- Ensuring Competence: The notary also has to make a reasonable judgment that the signer is aware, understands what they’re signing, and isn't incapacitated.

- Witnessing the Signature: This is the big one. The notary has to physically watch the borrower sign the document. Direct observation is the heart of the traditional method.

- Completing the Notarial Certificate: Finally, the notary fills out their official certificate, applies their stamp or seal, and logs the details in their official journal.

This time-tested method has been the gold standard for generations, but let's be honest, it’s not without its headaches. Think scheduling nightmares, travel time, and the potential for last-minute blow-ups that delay the whole closing.

The Rise of Remote Online Notarization

Things are changing, and fast. The execution of mortgage promissory notes is getting a major upgrade with the adoption of Remote Online Notarization (RON). This tech allows a borrower to sign and a notary to legally notarize documents from literally anywhere, all through secure audio-visual technology.

Instead of meeting face-to-face, the signer jumps on a live video call with a commissioned remote notary. And this isn't just some glorified Zoom call; it's a highly secure and regulated process from start to finish.

RON platforms use sophisticated identity verification methods, including knowledge-based authentication (KBA) questions and credential analysis, often creating a more secure and auditable record than a traditional in-person signing.

This shift isn't just about convenience—though that's a huge plus. It’s about building a more efficient, secure, and transparent closing experience. With RON, the entire signing session is recorded and securely stored. This creates an undeniable digital audit trail that protects everyone involved. Lenders, title companies, and borrowers can now wrap up closings in a fraction of the time, with fewer errors.

Legal Framework and Best Practices for eClosings

The legality of RON is solid. Federal laws like the ESIGN Act and UETA paved the way for electronic signatures years ago, and now the vast majority of states have passed their own specific laws authorizing notaries to perform remote online notarizations.

For an eClosing with a mortgage promissory note to be airtight, a few best practices are non-negotiable:

- Platform Security: You have to use a platform that offers bank-grade security, tamper-evident seals on the final documents, and a comprehensive audit trail of the entire session.

- Identity Proofing: The system must use robust, multi-factor authentication methods to slam the door on identity fraud.

- MISMO Compliance: Make sure the RON provider sticks to the standards set by the Mortgage Industry Standards Maintenance Organization (MISMO). This ensures everything is secure and compatible across the industry.

Platforms like BlueNotary are built to exceed these standards, offering a secure and user-friendly environment. By integrating these tools, lenders and title companies can slash closing times and cut operational costs. For a deeper dive into the technology and its legal standing, you can find great info on remote online notary platforms and their capabilities.

The mortgage promissory note itself is a linchpin of global finance. In the United States alone, the outstanding mortgage debt was around $11.5 trillion by the end of 2023, with nearly every one of those loans backed by a promissory note. The widespread use of these notes in the U.S. has set a standard for other major economies. You can learn more about how mortgage finance operates across OECD countries and the crucial role of standardized documents.

What Happens When Loan Payments Stop

A mortgage promissory note is a powerful promise, but what happens when that promise gets broken? When a borrower stops making payments, they fall into what the law calls default. That single act starts a domino effect, and the promissory note instantly transforms from a simple IOU into the lender’s primary weapon for enforcement.

This isn't just about missing a payment deadline; it's a formal breach of the entire loan agreement. The fallout can be serious, hitting a borrower’s credit score, their finances, and—ultimately—their ownership of the home. For a closer look at the legal mechanics of breaking a financial promise, our guide on understanding breach of contract goes into more detail.

The Acceleration Clause Kicks In

Once a loan is in default, lenders rarely just sit back and wait for the next payment that isn't coming. Buried in the fine print of almost every mortgage note is a critical tool called an acceleration clause. This gives the lender the right to demand the entire remaining loan balance be paid immediately—not just the payments you've missed.

Think of it as the lender pulling the emergency brake on the loan. Instead of collecting payments over 30 years, they can now legally demand every penny back, right now. It's a powerful move that often serves as the final warning shot before foreclosure proceedings begin.

The Note as Evidence in Foreclosure

If the borrower can't come up with the accelerated balance, the lender's next stop is usually foreclosure. In that legal battle, the mortgage promissory note becomes the star witness for the prosecution. It serves as undeniable proof of the debt and the borrower's failure to repay it as promised.

A lender can't even start a foreclosure without producing the original, unpaid note. This document is the legal bedrock of their claim, proving they are the rightful owner of the debt and have the standing to seize the property used as collateral.

The note, working hand-in-hand with the mortgage or deed of trust, creates a legal one-two punch. The note establishes the debt, and the mortgage provides the remedy—the right to sell the home to get their money back.

The way these notes are enforced isn't the same everywhere. For instance, in the European Union, the EU Mortgage Credit Directive sets standards for mortgage contracts, ensuring the role of the promissory note is clear and legally solid across different financial systems.

Borrower Remedies and Options

Even after a default, it's not always game over for the borrower. Foreclosure is an expensive, drawn-out headache for lenders, so they're often willing to find another way. This opens the door to a few potential remedies:

- Forbearance: The lender agrees to temporarily pause or reduce your payments, giving you breathing room to get back on your feet after a financial setback.

- Loan Modification: This is a permanent change to your loan's original terms. The lender might lower your interest rate or extend the repayment period to make the monthly payments more manageable.

- Reinstatement: The borrower catches up on all the missed payments, plus any associated fees, to bring the loan current and stop the foreclosure process in its tracks.

These options all hinge on clear communication and negotiation with the lender. The key is to act fast. Reaching out at the first sign of trouble is the best way to explore these alternatives and hopefully steer clear of the harshest consequences of default.

Understanding How Your Note Can Be Sold

It can be a bit of a shock to get a letter saying your mortgage has been sold. But don't worry—this isn’t a sign of trouble. It’s actually a totally normal and essential part of how the modern mortgage industry works. The reason it's possible boils down to a key feature of your mortgage promissory note: it’s a negotiable instrument.

Think of it like a personal check. Once you sign a check, the person you gave it to can endorse it and hand it over to someone else, who can then cash it. Your promissory note operates on a similar principle. It represents a valuable stream of future income (your monthly payments), making it an asset that can be bought and sold on the secondary mortgage market.

This whole process is what allows your original lender to free up cash to issue more loans, keeping the housing market moving.

The Mechanics of Transferring Your Note

When your original lender sells your loan, they're legally transferring their right to collect payments to a new owner. This formal transfer is called an assignment. The new owner—whether it's a massive bank, a government-sponsored entity like Fannie Mae, or an investment firm—becomes the party you are now legally obligated to pay.

To make the transfer official, the original lender has to properly endorse the promissory note. This usually happens in one of two ways:

- Specific Endorsement: The lender signs the note over to a specific, named company.

- Endorsement in Blank: The lender simply signs the note without naming a new owner. This makes it payable to whoever is physically holding the note, much like a blank check.

This endorsement is crucial. If a foreclosure ever becomes necessary, the company suing must prove it's the rightful "holder" of the note and has the legal standing to collect the debt. Simply having physical possession of a note endorsed in blank is often enough to prove it.

The ability to assign a mortgage promissory note is the engine of the secondary mortgage market. It transforms individual loans into tradable assets, providing the liquidity that underpins the entire home financing system. Your payment obligation remains exactly the same; only the recipient changes.

Keeping Track of Ownership in a Digital Age

You can imagine the logistical nightmare of tracking stacks of physical paper notes as they were sold and resold in the past. It was a massive challenge. Today, this process is almost entirely handled by sophisticated electronic systems.

The big player here is the Mortgage Electronic Registration System (MERS). Think of MERS as a central, digital library that tracks the ownership and servicing rights for millions of mortgage loans. Instead of filing a new assignment in dusty county record books every time a note is sold, the transfer is simply updated in the MERS system.

This makes the process incredibly efficient, cuts down on paperwork, and creates a clear, electronic chain of title for the promissory note. That transparency is vital for ensuring the right party can enforce the note if things go wrong.

Frequently Asked Questions

Even after you've got the basics down, the real world of mortgage promissory notes always seems to throw a few curveballs. Let's tackle some of the most common questions that pop up for borrowers, lenders, and closing agents to clear up any lingering confusion.

Can a Mortgage Exist Without a Promissory Note?

Technically, no. Think of it like this: the promissory note is the IOU, and the mortgage (or deed of trust) is the collateral you put up to guarantee you'll pay the IOU.

A mortgage is what secures the loan by putting a lien on your property. But without a promissory note, there's no actual debt for the mortgage to secure. The note creates the financial obligation; the mortgage is just the muscle behind it. For any standard home loan, you absolutely need both.

What Happens if the Original Note Is Lost?

Losing an original promissory note is a massive headache for a lender, especially if they need to foreclose. Because the note is a "negotiable instrument"—kind of like a check—courts often demand the lender produce the physical, signed document to prove they have the legal standing to collect the debt.

If the original is gone, the lender has to jump through some serious legal hoops to "re-establish" the note. This usually means digging up piles of evidence like affidavits and payment histories to prove the loan's terms and their right to enforce it. It's a process that can seriously delay or even derail a foreclosure.

A lost note can be a huge roadblock for lenders. This really highlights how crucial meticulous record-keeping is and shows the value of secure, digital eClosing platforms where original documents can’t be physically lost or damaged.

Does Refinancing Create a New Promissory Note?

Yes, 100%. When you refinance, you're not just tweaking your old loan—you're taking out an entirely new one to pay off and cancel the original.

This means your first promissory note is marked "paid in full" and becomes void. You'll then sign a brand-new promissory note with all the new terms: a different interest rate, a new loan amount, and a new maturity date. That new note becomes the legally binding promise for your refinanced mortgage.

Is a Home Equity Line of Credit a Promissory Note?

This is a great question and a common source of mix-ups. A typical home equity line of credit (HELOC) agreement is not a traditional promissory note. The key difference lies in one of the main requirements for a promissory note: it must be a promise to pay a "sum certain"—a specific, fixed amount of money.

With a HELOC, you're approved for a credit line and can draw different amounts over time. The total debt isn't a fixed sum from day one. Because of this legal distinction, enforcing a defaulted HELOC can be different from a standard mortgage foreclosure, as the lender has to prove the specific amounts that were actually drawn by the borrower.

Executing, storing, and managing these critical documents demands precision and top-notch security. BlueNotary offers a complete eClosing and online notarization platform, ensuring every mortgage promissory note is signed, notarized, and managed with bank-grade security and full legal compliance. Protect your most important assets and simplify your closings by visiting BlueNotary.