Small Estate Affidavit Texas (TX) Form

When a loved one passes away with a small estate in Texas, navigating the probate process can be complex and time-consuming. To access our Small Estate Affidavit Texas (TX) Form, click the button below. This template is crucial for simplifying the process of transferring assets to heirs and beneficiaries without the need for formal probate proceedings.

Save time, avoid headaches, and ensure compliance effortlessly with current version of Small Estate Affidavit Texas (TX) Form. With our streamlined process, you'll have your form in hand within moments, giving you the peace of mind to focus on what truly matters – your business.

Understanding the Template

Stay Organized, Stay Secure: Secure Your Small Estate Affidavit Texas (TX) Form Today

Are you overwhelmed by the complexities of probate administration for a small estate in Texas? It's a daunting and emotionally challenging task, isn't it? Spending valuable time deciphering legal requirements, gathering documentation, or worse, encountering delays that prolong the distribution of assets to rightful heirs. But what if there was a simpler solution? Imagine having a downloadable Small Estate Affidavit Texas (TX) Form readily available, allowing you to transfer assets efficiently. The Small Estate Affidavit Texas (TX) Form serves as a sworn statement by heirs or beneficiaries affirming their right to inherit assets from a decedent's estate. Whether it's real estate, personal property, or financial accounts, utilizing this template simplifies the asset transfer process for small estates in Texas. After downloading the template, make sure to customize it according to the specifics of the estate.How to Use the Template

Small Estate Affidavit Texas (TX) Form Instructions

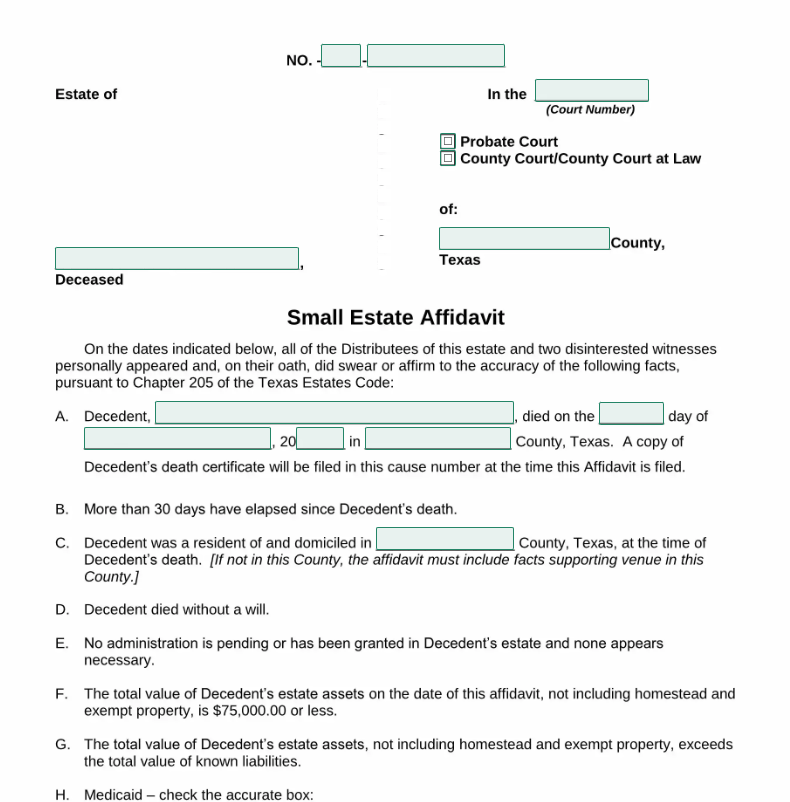

In the designated sections of the template, heirs or beneficiaries are required to input specific details, including the decedent's information, asset details, family relationships, and a description of the estate's value. Deceased Information: Clearly state the full name of the deceased individual, their date of death, and their county of residence in Texas at the time of death. Affiant Information: Provide the full name, address, and relationship to the deceased of the affiant (person filling out the affidavit). Asset Information: List the assets of the deceased that are subject to the Small Estate Affidavit, including a description of each asset and its estimated value. Debts and Liabilities: Disclose any known debts or liabilities owed by the deceased at the time of death, along with their respective amounts. Heir Information: Identify all heirs of the deceased, including their full names, addresses, and relationship to the deceased. This may include surviving spouses, children, parents, or other relatives entitled to inherit under Texas law. Oath and Signature: The affiant must swear under oath that the information provided in the affidavit is true and correct to the best of their knowledge. The affidavit must be signed and dated by the affiant in the presence of a notary public. Notary Acknowledgment: The affidavit must be acknowledged by a notary public, who will verify the identity of the affiant and witness their signature. It's crucial to ensure that all information provided in the affidavit is truthful and accurate. Any misrepresentations may invalidate the affidavit and delay the asset distribution process.Frequently Asked Questions

Heirs or beneficiaries of a small estate in Texas should use a Small Estate Affidavit Texas (TX) Form to transfer assets efficiently and avoid the time and expense of formal probate proceedings. It is typically used when the total value of the estate falls below a certain threshold set by Texas law.

A Small Estate Affidavit Texas (TX) Form is a legal document used to transfer assets from a small estate in Texas to heirs or beneficiaries without the need for formal probate proceedings. It provides a simplified process for asset distribution for estates with limited assets and no will.

You can download the Small Estate Affidavit Texas (TX) Form for free from reputable sources like our website BlueNotary or from legal and estate planning resources.

The Small Estate Affidavit in Texas allows for the transfer of a decedent's personal property, bank accounts, and potentially vehicles and real estate, provided the total estate value does not exceed the statutory limit set by Texas law, which is currently $75,000 excluding homestead property and exempt personal property. This tool simplifies the process for small estates without the need for formal probate proceedings.