Both buyers and homeowners indeed experience a high level of danger from real estate and scam. Fraudsters use different methods to steal from owners and buyers, who are left without any choice but to deal with the situation. The common method of virtual notarization has become a powerful tool to protect the rights of the property owners and to avoid fraud in the land registry. The article explains how the use of virtual notarization can reduce real estate fraud and lists the main reasons supporting its effectives.

1. A well-known fraud that triggers a variety of consequences: One such crime is real estate fraud, which entails bad actors impersonating homeowners and reaching out to real estate professionals or potential buyers. The criminals’ modus operandi takes many forms and one of the practices is their persuasion of the process by which homeowners get payment, and after they trick the buyers into using bank transfers, they will disappear, leaving the latter with no house and a pile of debt. This kind of fraud is so widespread that a new way of dealing with and preventing it is more than necessary.

2. In the context of pandemic, the role of virtual notaries turning to digitalization: To be specific, virtual notarization is not only a viable but also an effective solution on the issue of real estate fraud. The process of virtual notarization, a departure from the traditional face-to-face method deals with the issue of the security of signed documents by using high-speed video links, which guarantees the authenticity of the parties involved.

3. One of the most popular security practices in this industry is 2-step verification: Virtual notarization is a process that is stringent in the checking of the actual identification of the signer through the multi-layered verification process from the traditional notarization approach. The signer of the documents has the obligation to show his or her name and the demonstration of the knowledge-based verification process with the use of unique identifying elements of the signatory. The more reliable knowledge-based method makes it unrealistic for the criminals to get access to private information. Such a multifaceted validation process will indeed lay a strong foundation for future transactions that are secure in every way.

List two items only with no spaces or additional characters between them.

Audio-Visual Verification: A must-have condition for virtual notarization is the uninterrupted audio-visual presence in the process. This requires everyone including the notary and the signer to be audible and visible from the beginning to the end of the notarization. The availability of an audio-visual recording system is a highly effective preventive measure as it will certainly deter possible wrongdoers by the fact that their faces/actions would be filmed without their consent.

Visual Inspection of Identification: Virtual notaries carry out visual checks of the identification documents uploaded in order to raise the security level higher still. By matching the ID with the person shown on the screen, virtual notaries ensure the participation of the individual who is possibly the rightful owner or authorized party in the transaction. This further examination ensures that the process is conducted with the highest level of trust.

The Cumulative Effect: The combination of these three main components of virtual notarization, namely two-factor authentication, audio-visual verification, and visual ID inspection, acts as the best protection against real estate fraud. Each measure in this system supports the others making it harder for the fraudsters and therefore, it is a system which greatly decreases the risk of fraud from many points of view.

Real estate fraud is a continuous problem which requires the implementation of active measures in order to protect the owners, buyers, and the implementation of the transactions. Virtual notarization has proven to be a revolution in the fight against fraud and besides, it provides further security elements that are not usually available in processes handled in person.

The use of two-factor authentication, continuous audio-visual verification, and visual ID inspection do not only diminish the possibility of, but also help to overcome the threats of fraud in the transactions, which in turn, build trust and confidence among the parties involved.

As technology advances, the integration of virtual notarization plays a vital role in safeguarding the real estate sector against fraudsters.

If you require any further information or want to receive the latest information regarding real estate fraud prevention, please contact us. Also, do not forget to subscribe for further updates and know more about this problem in detail.

BlueNotary Fighting Fraud. One Day at a Time.

Not being careful with the notarization process and ignoring the proofs leads to the public being victims of various scams of a large scale that deprive them of their money.

The notaries public are holders of a very important trust position. Trust that can easily change hands and be exploited through fraud if not closely monitored. In the past, officials had been deceived by several notarization scammers.

For example, in 2017 a notary public in California made more than 100 fake deeds that caused a huge loss of $60 million. The notary public did not thoroughly verify the signers’ identities, so fraudsters easily masked themselves as property owners. The same situation also occurred in Florida where the notary was the person behind the $1 billion fraud by counterfeiting bill of sales for yachts and other luxury items.

Online Notarization stops Fraud by requiring and enhancing authentication

In the examples mentioned above, the notaries were found to be negligent and were charged with multiple felonies for being involved in these scams. The situations mentioned hereinbelow elucidate that notaries should not only confirm each signer’s identity but also anticipate volunteers to verify the contents to sign and inform them of the possible consequences of their actions. Disclosing these circumstances can make it feasible for kleptoparasites to lay claims on plundered assets and consequently go through the process of obscuring the sources of the illegal funds, something more likely to happen to the wronged parties.

Notarization may seem like a routine step, but in reality, it is all about focus, diligence and integrity. Notaries should keep to a high standard to prevent the possibility of them becoming unwitting perpetrators of the fraud. BlueNotary helps teams be alert and make sure they go through the proper procedures to identify and verify the persons who sign the documents. Notaries are enabled to employ BlueNotary in such a way that they not only can fight against exploitation but also can protect the entire notarization process from losing its integrity.

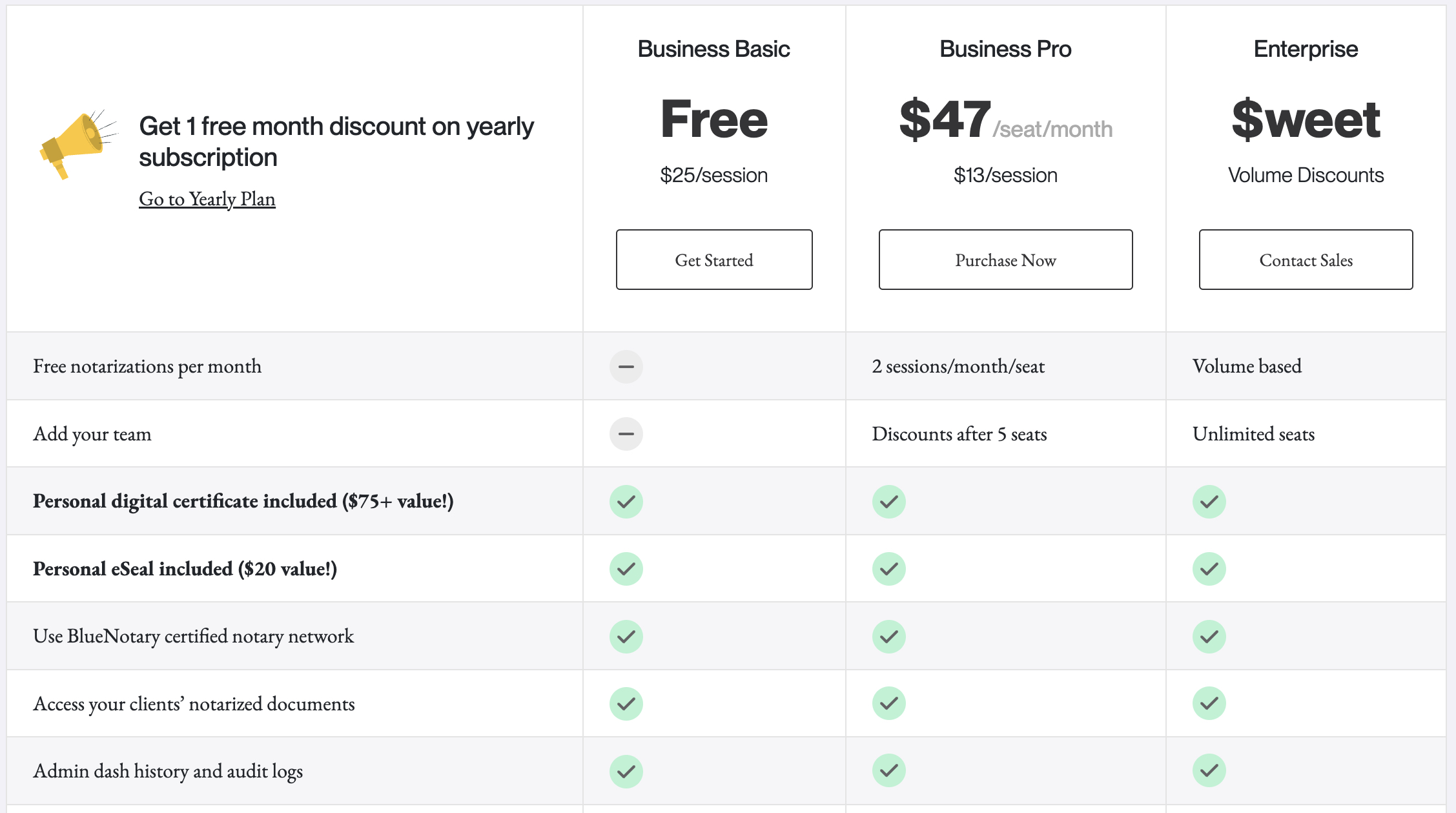

Learn about the Influence of BlueNotary:

In order to dive deeply into the virtual notarization tool that is suitable for your law firm, we suggest that you book a discovery call with our team at BlueNotary. You are also able to sign up and check out the platform if you feel like it. Our experts are at your service to take care of important queries and provide you with a detailed guide to quickly implementing this innovation in your firm.