It’s been a long time since the Lending Industry has seen a technological revolution such as this. For a long time, the standard method for Lenders to go about completing a Loan Closing has essentially been to use a paper and quill. At some point, people started using pens but the process has more or less stayed the same.

Now things are changing with the advent of Remote Online Notarization for Lenders and their clients. Back in 2017, only 5 states allowed Remote Online Notarization to their residents.

5 years later only 7 states remain in the union that are not allowing their notaries and signing agents to conduct signings online. The change to the industry is coming and it is coming quickly.

Lenders Should Know: NASS

At present, the NASS (National Association of Secretary of States) has handed over authority to the individual states for legality. But bills are set to go forth in the Senate after already passing in the house with backing from major national organizations such as the American Land Title Association and the Mortgage Bankers Association to legalize Remote Online Notarization nationwide.

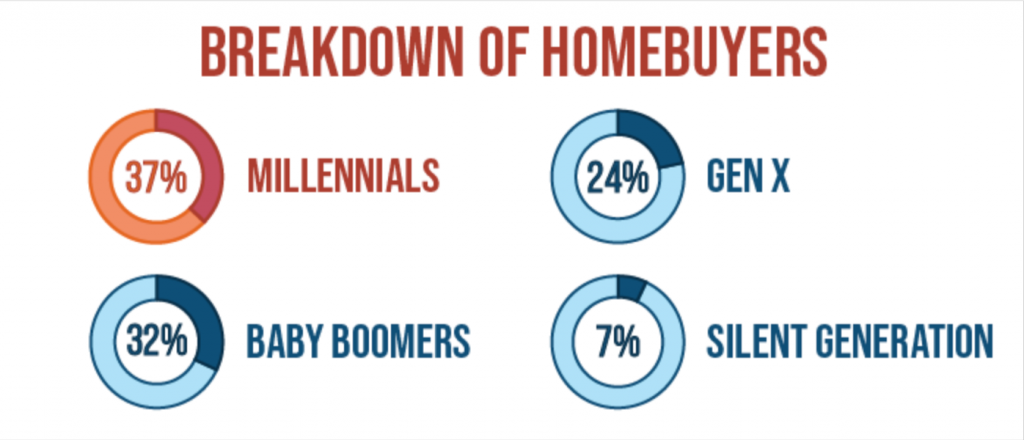

The demand is now coming from both sides of the market, the seller side and the buyer side (especially for millennial homebuyers wanting an Online Closing experience).

Lenders Should Know: It Pays to be an Early Adopter

It stands to reason that early adopters will hold an advantage over their local lagging counterparts. The fact of the matter is, that unless signers are part of a group that never kept up with modern technology. People just want to get their signings done in the most efficient way possible. And the amount of tech-savvy homebuyers will only be increasing as time marches forward.

Remote Online Notarization enables a Notary to help conduct a borrower signing session virtually through live videoconferencing. This even opens up the door for getting deals closed when signers are across state lines, as long as the servicing notary is within boundaries. You will need to check with your local governing body to confirm legality.

Leveraging this digital technology allows for signing to get done faster and easier.

To date, over $XXX has been invested into the budding industry from major players who make a living off of projecting the future of markets. At a time sooner than later, Remote Online Notarization will be a requirement for Mortgage Lenders.

It is to compete in the already competitive market. The majority of the competitors in the field have recognized that it is vital to adopt RON if they want to provide their clients with 100% contactless end-to-end mortgage closings.

How to Get Started

For lenders looking for how to get caught up and started, it is pertinent to use a platform that offers best-in-class RON capabilities. The Mortgage Industry Standards Maintenance Organization, MISMO, has already been serving as a standards board for the industry. RON platforms that are MISMO-certified hold a competitive edge in the field. You can be sure these platforms have been approved to provide the security and ease necessary to get all your lending and closing tasks accomplished.

To see how easy you can get your team up and running you can book a Remote Online Notary Solutions Demo through BlueNotary. There you’ll get a full breakdown on how exactly you can catch up to the rest of the pack and stand out from the crowd.