Think of a partial release of lien as opening one compartment of a secured vault on your property after a payment. You free up value in stages while the rest stays protected.

Quick Overview Of Partial Release Of Lien

A partial release of lien is a legal instrument filed with the county recorder that removes lien rights from a defined portion of real property. You’ll see this most often in multi-phase construction projects or when developers sell off individual lots.

It’s like unlocking one vault compartment at a time for each payment milestone. Owners gain liquidity. Contractors secure progress draws.

Key Advantages:

- Improved Cash Flow: Release equity for refinancing or sale

- Reduced Title Risk: Keep unpaid work encumbered only

- Phased Funding: Align payments precisely with completed work

- Stakeholder Confidence: Show tangible proof of paid milestones

Typical Players:

Property owners, general and subcontractors, lenders, and title insurers.

Requests usually follow agreed payment milestones or loan disbursement events.

How Partial Releases Work

Each release spells out the exact legal description and amount lifted, while preserving the remaining lien balance. States dictate specific forms, filing windows, fees, and notary acknowledgement requirements.

Most jurisdictions require recording within 30 days of execution. Notary seals and recording costs can vary by county.

Before we dive into the details, here’s a snapshot of the main benefits:

Summary Of Partial Release Benefits

| Stakeholder | Benefit | Typical Use Case |

|---|---|---|

| Property Owner | Frees up equity for sale or refinance | Selling or refinancing a lot |

| Contractor | Guarantees partial draw | Phased construction payments |

| Lender | Minimizes title risk | Approving next loan tranche |

These highlights show why partial releases are such a practical tool.

BlueNotary’s remote notarization and eClosing features wrap this into a 10-minute workflow. Live video ID checks and audit trails cut errors by 30%, while eRecording compliance slashes title office rejections.

Read our guide on what it means to be in escrow to understand how held funds interact with lien filings.

This overview sets the stage for detailed steps, state variations, and sample forms in the sections ahead.

Understanding Key Concepts

A partial release of lien lets a property owner free up a specified segment of equity after making a partial payment, while the remaining portion stays under lien protection. Think of it like opening a few lanes on a toll road after payment—traffic moves, but other lanes stay closed until further tolls are paid.

Stakeholders in this process include:

- Claimants (contractors or suppliers seeking payment)

- Obligors (owners or developers arranging funds)

- Recording offices (where lien documents are filed and indexed)

Claimants, Obligors, and Recorders

Claimants hold onto lien rights as security for labor or materials they’ve provided.

Obligors authorize payments that unlock slices of property value.

Recording offices make sure releases are properly documented and searchable by the public.

Before diving deeper into partial releases, it helps to understand what a construction lien is. Read more in understanding construction liens.

In many developments, partial releases coincide with phased projects—when developers sell individual lots or draw down on construction loans at different stages.

Partial releases open only specific lanes while others hold lien rights, maintaining protection on unfinished work.

Partial Vs. Full Release

A partial release removes lien rights on just a portion of the property. A full release clears all encumbrances once the final payment is made.

- Scope: partial covers segments; full covers the entire project

- Timing: partial aligns with interim milestones; full follows project completion

- Protection: partial maintains security over remaining work; full discharges all claims

Why Use Partial Releases

A partial release of lien serves as a practical tool in construction and real estate to provide liquidity without sacrificing security. In the U.S., it’s common for owners to free up equity in finished sections while ongoing phases stay protected. Imagine a contractor finishes 60% of a building, receives payment for that work, and then issues a partial release to clear that portion—letting the owner sell or refinance just the completed area.

Discover more insights about mechanic’s liens.

The screenshot above shows a typical mechanic’s lien entry, highlighting the need for a clear property description and the exact amount owed.

Common uses for partial releases include:

- Subdivided land sales unlocking individual lots

- Phased draws on construction loans

- Progress payments tied to completion milestones

Regional Variations

Most U.S. states support partial releases but prescribe their own form names and filing deadlines. Canada and New Zealand offer similar mechanisms under different terminology and procedures.

State rules can vary on:

- Level of detail required in the release document

- Timeframes for filing after payment

- Specific language or statutory references

Negotiating payment timing and release conditions early in a contract can sidestep disputes and avoid costly delays.

Moving Forward

With these foundational ideas in place, you’re ready to tackle the legal nuances of drafting, negotiating, and recording a partial release of lien. Next, we’ll explore the precise legal requirements and step-by-step recording process to ensure full compliance.

Legal And Recording Requirements

Getting a partial release of lien filed correctly means you’re playing in two sandboxes at once: federal rules and local recording office quirks. One wrong move, and you could face delays or even penalties.

Let's break down what you need to know about IRS tax liens, mortgage releases, and the maze of state-specific filing rules to keep your transaction on track.

At the federal level, agencies like the Internal Revenue Service and banking regulators have strict deadlines for releasing liens after a debt is paid. For instance, mortgage lenders typically have to file a release within 30 days of a loan payoff to stay on the right side of federal guidelines and avoid getting hit with fines.

Federal Guidelines

- IRS Tax Lien Releases: Once a tax debt is settled, the IRS is required to issue a certificate of release under IRC 6325 within 30 calendar days.

- Mortgage Payoff Releases: Lenders are generally mandated to file lien terminations in county records within 30 days after confirming the loan has been paid in full.

- Notarization Requirements: This varies from place to place, but nearly every jurisdiction requires a formal acknowledgment block signed and stamped by a licensed notary public.

- Recording Fees: These are set by each county and can run anywhere from $10 to $75 per document.

Key Insight: Don't drag your feet on filing. A delayed lien release can bring a property owner's refinancing plans to a screeching halt and leave lenders exposed to serious financial penalties.

State Variations

While federal laws provide a baseline, the real nitty-gritty comes down to state and county rules. What's called a "Partial Release of Deed of Trust" in California might be a "Partial Discharge" in New York. Deadlines and filing methods also differ, making it crucial to check local requirements every single time.

Here's a quick look at how things can vary in a few key states.

Comparison Of State Lien Release Requirements

| State | Form Name | Deadline | Electronic Option |

|---|---|---|---|

| California | Partial Release of Deed of Trust | 30 days | Yes |

| Texas | Partial Satisfaction of Lien | 30 days | Limited |

| Florida | Partial Lien Release Form | 30 days | Yes |

| New York | Partial Discharge | 30 days | Yes |

This table is just a starting point. Always remember that form names, deadlines, and fees can change based on local laws and county recorder practices. This is where modern tools really shine. Electronic recording (eRecording) and remote online notarization (RON) platforms can dramatically reduce rejections and get documents filed faster.

Platforms like BlueNotary give you secure remote notarization, complete audit trails, and instant document delivery to meet all the legal requirements.

- Slash recording errors by up to 30%.

- Cut turnaround times from days to mere hours.

- Integrate directly with county eRecording systems.

Compliance Challenges

One of the biggest tripwires in a partial release is the legal description. It has to be exact and match the original lien or mortgage document perfectly.

Forgetting a lot number or mistyping a parcel ID is a surefire way to get your document rejected by the county clerk, sending you back to square one. You absolutely have to review the county’s checklist for fees, formatting rules, and signature block requirements before you submit anything.

BlueNotary’s eClosing suite helps head off these problems by automating document validation and walking signers through the notarization process step-by-step, minimizing common mistakes.

Lenders must release liens within a set timeframe, often 30 days, to avoid legal trouble. This becomes especially critical in situations like subdivided land sales, where a partial release frees up one piece of the property while the lien remains on the rest. If you're interested in a deeper dive, Wolters Kluwer offers great insights on navigating compliant mortgage lien releases.

To see how BlueNotary's workflows can help, check out our guide on title and escrow processing.

Whether you're dealing with an IRS tax lien or a private mortgage, staying on top of deadlines and recording details is everything. Clarity, accuracy, and timely filing are your best defenses against title risks and transaction delays.

Best Practices

- Verify the legal description. Double- and triple-check it against the original documents before you draft anything.

- Confirm the notary language. Make sure the acknowledgment wording meets your specific state's requirements to the letter.

- Go digital. Use eRecording and remote notarization whenever possible to speed up the whole process.

By using tools like BlueNotary’s remote notary, audit trail, and eClosing suite, you can navigate these complex rules in under 45 minutes and cut errors by 30%. Getting compliance right protects everyone involved and clears the way for the next phase of the transaction.

Key Takeaways

- Always check both federal laws and local recording rules before starting.

- Ensure notarization acknowledgments are perfectly aligned with state law.

- Use precise property identifiers, including the lot, block, and subdivision name.

- Take advantage of BlueNotary’s eRecording integration to avoid rejections.

Staying ahead of deadlines with lien releases will always save you time, money, and headaches. Whether you’re carving up a parcel of land or closing out a mortgage, precise recording is what keeps your deal moving forward. Modern eNotary and eRecording services are the best way to get it done right.

Step By Step Process To Obtain And Record

Getting a partial release of lien from start to finish isn't complicated, but it does demand a methodical approach. Think of it less like a single action and more like a short journey with distinct milestones. Each step builds directly on the one before it, and missing a single detail can bring the whole process to a screeching halt.

It’s a bit like assembling a piece of furniture—you can't just skip a step or grab the wrong screw and expect a sturdy result. To make sure you get it right the first time, here’s a clear roadmap for obtaining and recording the document correctly.

Step 1: Verify Lien Rights and Payment

Before a single word of the release is written, everyone involved needs to be on the same page financially. The person who filed the lien (the claimant, like a contractor or supplier) has to confirm the exact unpaid balance of the original lien.

At the same time, the property owner needs to show clear proof of the partial payment that warrants the release. This could be a bank statement, a canceled check, or an official receipt. Getting this initial verification locked down prevents arguments later and ensures the release is grounded in solid financial facts.

Step 2: Draft the Release Document

Once the payment is confirmed, it's time to actually prepare the partial release of lien document. This isn’t a form you want to rush through; the details are everything. To be legally sound, the document must include several critical pieces of information.

- Accurate Legal Description: This is where things most often go wrong. The release has to spell out the exact portion of the property being released from the lien, using the same legal description found in the original lien filing (think lot, block, and subdivision name).

- Parties Involved: Clearly identify both the lien claimant (lienor) and the property owner (lienee), making sure to use their full legal names and current addresses.

- Original Lien Information: You have to tie the release back to the original lien. Include its recording date and the instrument number (often the book and page number) from the county recorder’s office.

- Release Language: The wording needs to be explicit. State that the lien is being partially released for a specific amount and, just as importantly, clarify that the lien remains in full effect for the remaining balance on the rest of the property.

Step 3: Execute and Notarize the Document

With the document drafted and double-checked by everyone, it needs to be properly signed, or "executed." The lien claimant is the one who signs the release, since they're the party giving up their claim on that piece of the property.

This next part is non-negotiable: the signature must be notarized. A notary public is there to verify the signer’s identity and witness the signature, adding their official seal to confirm the document is authentic. This is a hard-and-fast legal requirement in just about every state.

This is where modern tools can save a ton of time. Platforms like BlueNotary let you get this done remotely in less than 10 minutes. Through a secure video call, a commissioned notary can verify an ID and apply a digital seal, making the whole process faster and way more convenient for people in different locations.

Step 4: Record the Release and Confirm Filing

The final, and arguably most crucial, step is to get the executed and notarized partial release filed with the same county recorder’s office where the original lien was recorded. This action makes the release a part of the public record, which officially clears the title for that specific portion of the property.

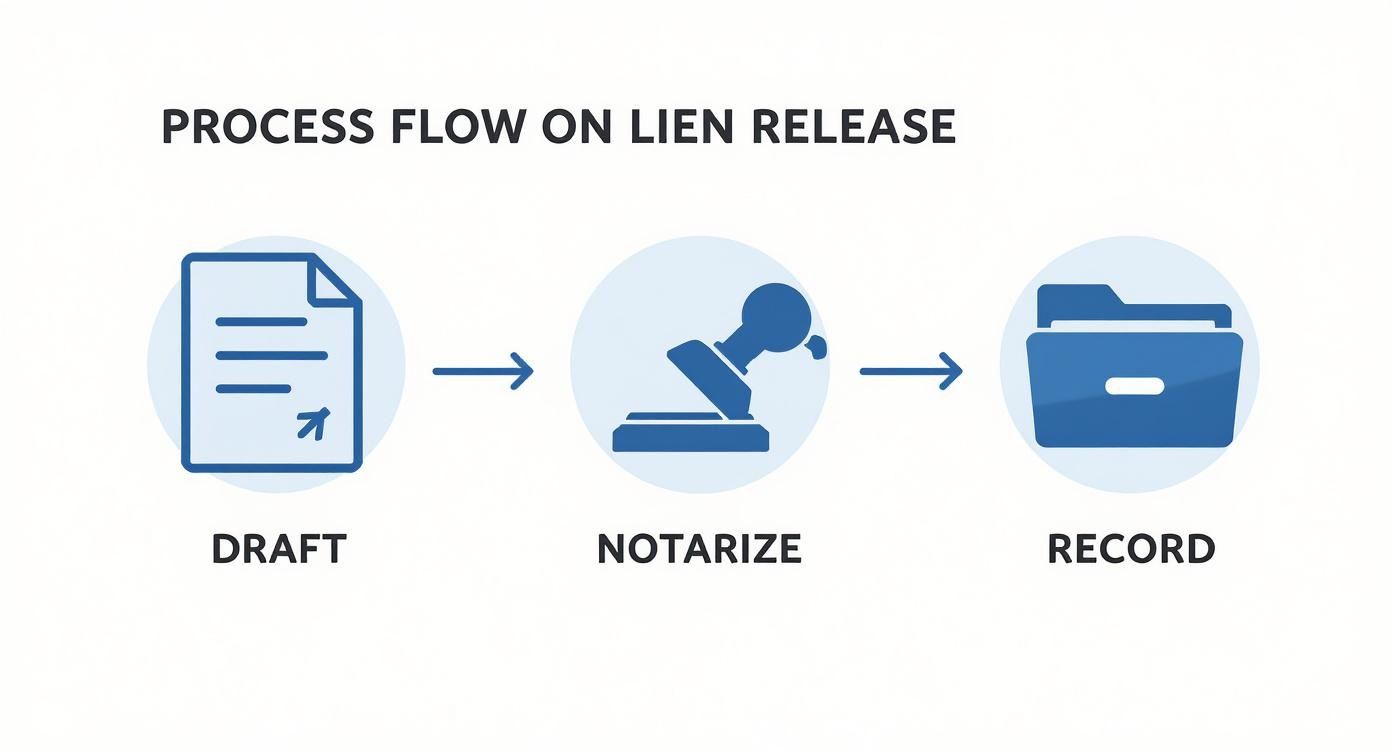

This simple workflow shows how the core steps connect.

As the visual shows, drafting, notarizing, and recording are three separate but equally essential stages for the release to be effective.

After you’ve submitted the document—whether you walked it in, mailed it, or used an eRecording service—you're not quite done. You need to confirm it was successfully filed. You can usually do this by checking the county’s online portal or by requesting a recorded copy. This final confirmation is your proof that the lien on that chunk of property is officially gone, saving you from major title headaches down the road.

Sample Language And Forms

A partial release of lien only works when its language is spot-on. Generic templates are a helpful start, but you’ll always need to tweak them to match your exact deal and your county’s rules.

Think of a template like a basic cooking guide. You still have to measure the exact ingredients—the property description, payment figures, dates—to avoid a “kitchen disaster” at the county clerk’s office. Mix one wrong detail and you’ll face costly delays.

Core Components Of Any Partial Release Form

Every partial release needs a handful of non-negotiable sections to ensure it records cleanly against the property:

- Identification of Parties: List the lienholder’s and the owner’s full legal names and addresses.

- Original Lien Details: Cite the original lien’s recording date plus its book/page or instrument number.

- Precise Legal Description: Spell out the exact portion of the land released, using lot, block, and subdivision data from official records.

- Consideration: Specify the dollar amount paid that triggers the release.

Key Takeaway: The legal description trips up most filers. Phrases like “completed portion of the building” simply won’t cut it. Go with a formal description such as “Lot 5, Block B, of the Sunshine Estates Subdivision.”

Customizing Language For Different Scenarios

Context matters. A release for a construction draw reads differently than one freeing up a single lot under a blanket mortgage.

For Construction Liens:

Clearly state the release covers only the work paid for by this draw. Add wording that preserves the lienholder’s rights for any unpaid labor, materials, or future phases.

For Mortgage Liens:

When a developer sells one lot from a larger tract, you’re invoking the partial release clause in the mortgage. The form must say the lender releases only that lot, while the rest of the security stays intact.

To see these ideas in action, compare structures in the official Florida lien satisfaction form template.

Notarization And Digital Execution

The notarization block is the final stamp of approval. A commissioned notary public must sign, seal, and confirm the signer’s identity—or the courthouse will bounce the document.

This is where online tools shine. With BlueNotary, you can:

- Connect with a live, commissioned notary 24/7 via secure video

- Complete ID proofing in minutes

- Apply a legally valid digital seal

- Skip travel, scheduling headaches, and bad notarizations

Your partial release gets executed correctly and streams straight into eRecording.

Below is a table titled undefined. Description: undefined.

| Column 1 | Column 2 |

|---|---|

| Data A | Data B |

| Data C | Data D |

This brief table illustrates the undefined structure in a clear, digestible way.

Common Pitfalls and How to Avoid Them

Getting a partial release of lien right comes down to precision. Just one small oversight can quickly snowball into expensive project delays, messy title complications, or even a full-blown legal battle. The key to keeping your deals on track is learning to spot these common mistakes before they happen.

Even the most seasoned pros can get tripped up by simple errors. We're talking about a single mistyped number in a property description or a missed signature—the stakes are high. These aren't just minor clerical issues; they are serious roadblocks that can freeze funding and put a sale in jeopardy.

Inaccurate Legal Descriptions

Hands down, the most frequent pitfall is an incorrect or vague legal description of the property getting released. The document has to spell out the exact portion of the property with the same level of detail as the original lien, right down to the lot, block, and subdivision.

Using fuzzy language like "the completed west wing" is a guaranteed way to get your document rejected at the county recorder's office. An error like this can stall a closing or hold up a construction draw for weeks while the document is corrected, re-signed, and re-notarized.

Best Practice: Always copy the legal description word-for-word from the original recorded deed or lien. Never try to abbreviate or paraphrase. A single misplaced comma or wrong parcel ID can render the entire release invalid.

Missed Deadlines and Improper Filing

County recorders and government agencies operate on strict timelines. For instance, the IRS has to issue a tax lien release within 30 days after the debt is paid off, and many states have similar rules for mortgage releases. Blowing past these deadlines can lead to penalties and legal headaches.

Even federal tax liens, which are notoriously rigid, can involve a partial release of lien. This might happen if only a part of the property is sold or if a bond is posted to cover some of the tax debt during a dispute. You can find more details in the IRS's own guidance on federal tax lien release procedures.

Filing in the wrong county or forgetting to include the right recording fee is just as bad. These simple administrative slip-ups will get your document sent right back to you, forcing you to start the clock over on the entire filing process.

Defective Notarization and Signatures

A partial release of lien is just a piece of paper until it's properly executed. That means it must be signed by the right person—the lien claimant—and that signature needs to be correctly notarized.

Some of the most common notarization mistakes we see are:

- Missing Notary Seal: Forgetting the official stamp or embosser.

- Incorrect Acknowledgment: Using generic notary language that doesn’t meet specific state laws.

- Expired Commission: The notary’s commission wasn't active on the date of the signing.

Any one of these errors is enough for the recording office to reject the document on the spot.

How to Prevent These Pitfalls

The best defense is a good offense. Proactive planning and the right tools can help you sidestep these common mistakes entirely. This is where platforms like BlueNotary really shine, simplifying the whole process and slashing the risk of human error.

The system has built-in checks that make sure every required field is filled out before anyone can sign. Better yet, its remote online notarization (RON) feature ensures that a certified, state-commissioned notary handles every step correctly, creating a secure and compliant digital trail. This transforms a complicated, error-prone task into a smooth and predictable workflow, keeping your project moving and your property title clear.

Still Have Questions?

Navigating the world of property liens can feel a little tricky. Let's break down some of the most common questions that pop up about partial lien releases to give you a clearer picture.

What Exactly Is A Partial Release Of Lien And When Should I Use It?

Think of a partial release of lien as a tool that lets you free up a specific piece of a property from a larger lien, usually after you've received partial payment. It’s a way to unlock value in stages without giving up your right to get paid for the rest of the work or materials supplied.

It's incredibly useful for:

- Freeing up equity on completed phases of a project.

- Allowing the property owner to sell or refinance a specific portion that's now clear.

- Keeping your lien firmly in place on the remaining, unpaid parts of the job.

How Do State Recording Requirements Differ For Partial Releases?

This is where you need to pay close attention, because every state plays by its own rules. The name of the form, filing deadlines, fees, and whether you can record it electronically can all vary.

For example, some states might require you to file the release within 30 days of signing it, while others are more flexible. Likewise, some counties are fully equipped for eRecording, while others still operate the old-fashioned way. Always, always check with the local county recorder’s office to get the specifics on their required language and notary rules.

| State | Form Name | Deadline | ERecording |

|---|---|---|---|

| California | Partial Release of Deed | 30 days | Yes |

| Texas | Partial Satisfaction of Lien | 30 days | Limited |

| Florida | Partial Lien Release Form | 30 days | Yes |

Remote Notarization Acceptance

Can I Use Electronic Notarization For A Partial Release Of Lien?

Absolutely, in many places. Platforms like BlueNotary make remote online notarization (RON) possible, but you have to do your homework first. You'll need to confirm that your specific county recorder's office accepts documents notarized electronically. Once you get the green light, just follow their identity verification and submission steps to ensure it goes through smoothly.

“Remote notarization can reduce filing errors by up to 30% and speed up approval times dramatically.”

What Happens If A Partial Release Is Filed Incorrectly?

A simple mistake—like a typo in the legal description, the wrong dollar amount, or an improper notarization—can bring the whole process to a screeching halt. If your document gets rejected, you're looking at a do-over.

Typically, you'll have to:

- Draft a whole new "corrective affidavit" to fix the error.

- Track everyone down to sign and notarize it all over again.

- Resubmit the corrected document to the recorder’s office.

This isn't just a headache; it can add days or even weeks to your timeline and hit you with extra filing fees.

How Can I Confirm My Partial Release Has Been Recorded?

Don't just file it and forget it. After you submit the release, make it a habit to check the county recorder’s online portal or request a certified copy of the recorded document. Most counties let you search by document number, property owner, or parcel ID. This simple step gives you peace of mind and ensures there are no lingering clouds on the property title.

Additional Tips

What Strategies Prevent Common Filing Mistakes?

A little planning upfront can save you a world of trouble later. The key is to be meticulous.

- Copy the legal description exactly as it appears on the original lien document. No paraphrasing!

- Double-check every name and address for correct spelling.

- Consider using eRecording and remote notarization. Digital processes are great at catching human errors before they become a problem.

Pro Tip: Create a simple checklist for every partial release you handle. It sounds basic, but building this into your workflow can save hours and dramatically reduce rejections.

Can I Use A Partial Release For Subdivided Lot Sales?

Yes, this is a classic use case for developers. When they have a blanket mortgage covering an entire subdivision, they use partial releases to free up individual lots as they're sold. Each release has to be crystal clear, referencing the specific lot number and adhering to the partial release clause in the original mortgage. Get the lot number wrong, and you could accidentally void the release for that parcel.

Should I Hire An Attorney For A Partial Release Process?

For straightforward releases, you might not need one. But if things get complicated, a lawyer is your best friend.

You should definitely seek legal advice if there's a dispute over payment amounts, if the document language is confusing, or if multiple parties have claims on the property. An attorney will make sure you’re following state law, protect you from recording errors, and help you draft terms that truly protect your interests.

Ready to simplify your partial release of lien process with fast, compliant remote notarization? Try BlueNotary.